Disney reported its first quarter fiscal year 2023 earnings for last October through December on February 8, 2023. This covers the good & bad of these results from the first year of the Walt Disney Company’s second century, including Genie+ sales at Walt Disney World & Disneyland, another quarter of increased revenue from theme parks, surprising Disney+ subscriber losses, and more.

For starters, this is Disney’s first earnings call since the return of CEO Bob Iger and firing of Bob Chapek. We’ve been covering the “Battle of the Bobs” for what feels like an eternity, but in actuality, it’s been just shy of 3 months. In fact, the last earnings call acted as an accelerant, with analysts and talking heads openly calling for Chapek’s firing as a result of his “delusional” delivery on the earnings call.

During the earnings call, Iger is expected to unveil his plan for big organizational and structural changes that are expected to be implemented by the Walt Disney Company very soon. Upon returning, Bob Iger wasted no time in reshaping Disney announcing restructuring of Disney Media and Entertainment Distribution. It’s expected that Iger will return power to the creative divisions, while also facing industry sea changes, and creating a more efficient and cost-effective structure.

Against that backdrop, let’s turn to the numbers. The first quarter of the Walt Disney Company’s 2023 fiscal year (or the fourth quarter of the calendar year) is another quarter of positive results, although not with the same levels of growth seen in prior quarters due to tougher prior-year comparisons.

The Walt Disney Company beat Wall Street estimates on the top and bottom line, with earnings per share (EPS) of 99 cents per share versus 78 cents per share expected (that’s down as compared to $1.09 per share in the prior-year quarter). Revenue was $23.51 billion vs $23.37 billion expected.

For the first time ever, Disney+ lost 2.4 million subscribers, as compared to a gain of 12.1 million in the previous quarter. The number actually exceeded Wall Street expectations, with average forecasts anticipating a loss of around 3 million new subscribers. Analysts on average expected the Disney+ streaming service to reach 147.76 million subscribers for the quarter.

The reason why this drop beat expectations is a couple of factors. One is the Disney+ price hike in the last quarter, which made the service more expensive and thus likely contributed to churn. More significant than that is the expiration of the 3-year deals for Disney+ that were first offered at the D23 Expo prior to the launch of the Disney+ streaming service. That was a great way of pumping up the subscriber count and giving Disney+ a runway for (very) slowly launching content as the streaming service found its footing.

Direct-to-consumer (DTC) revenues for the quarter increased 13% to $5.3 billion and the operating loss for the quarter increased $0.5 billion to $1.1 billion. This is the third consecutive quarter that streaming has racked up over $1 billion in losses. The increase in operating loss was due to a higher loss at Disney+ and a decrease in results at Hulu, partially offset by improved results at ESPN+.

This left Disney+ with a total of 161.8 million paid subscribers worldwide. The company also reiterated its guidance of of reaching profitability on Disney+ by 2024, but did not offer guidance as to the subscriber count (it was previously 230 to 260 million). Currently, total subscriptions across all direct to consumer offerings exceed 234 million, thanks to additional growth at ESPN+ and Hulu.

Even prior to this, it’s been a good year for the company’s stock, with the share price up 25% thus far this year. As I’m writing this, the stock is up to $115 after hours, after falling below $90 per share following the last earnings call. That’s still down considerably from Disney’s highs of 2021, but literally every single streaming stock is down in that same time.

As we’ve discussed previously, there has been a trend across the board with a reevaluation of streaming services, driven by disappointing quarters of growth for Netflix. Although its 2023 results have been better, Netflix posted its first net losses of subscribers from quarter to quarter last year, resulting in Netflix’s stock price and that of its competitors (Warner Bros, Paramount, Comcast, Disney) to be hit hard.

Consequently, investors are reevaluating metrics for measuring success–and streaming services themselves are rethinking their approaches. Most notably, Warner Bros. Discovery announced a seismic shift in content strategy that caught Hollywood and fans by surprise. Since then, other streamers have moved quickly to cut costs.

In large part, this is why Disney’s share price is up after hours despite Disney+ losing 2.4 million subscribers. However, this was this expected by Wall Street analysts, who are undoubtedly pleased by the subscriber and advertiser response to Disney’s new streaming tiers.

Of particular interest to us is Parks, Experiences and Products (DPEP or Parks & Resorts). DPEP saw a 21% increase in revenue to $8.7 billion during the most recent quarter, as compared to $7.2 billion in the prior-year quarter. Over $6 billion of that came from theme parks.

According to the company, higher operating results for the quarter reflected increases at Walt Disney World, Disneyland, and Disney Cruise Line. as well as the international parks (to a lesser extent). Operating income growth at the domestic parks and experiences was due to higher volumes and increased guest spending, partially offset by cost inflation, higher operations support costs and increased costs for new guest offerings.

Higher volumes were attributable to increases in passenger cruise days, attendance, and occupied room nights. Guest spending growth was due to an increase in average per capita ticket revenue driven by Genie+ and Lightning Lanes, which were introduced in the prior-year quarter.

Increased results at the international parks and resorts were due to growth at Disneyland Paris and higher royalties from Tokyo Disney Resort, partially offset by a decrease at Shanghai Disney Resort. Higher operating results at Disneyland Paris were due to an increase in volumes and higher guest spending, partially offset by a loss on the disposal of our ownership interest in Villages Nature, increased costs for new guest offerings, and cost inflation.

Higher volumes consisted of increases in attendance and occupied room nights. Guest spending growth was driven by an increase in average ticket prices and higher average daily hotel room rates. The decrease at Shanghai Disney Resort was due to lower attendance resulting from fewer operating days in the current quarter compared to the prior-year quarter as a result of closures.

The earnings document also revealed that capital expenditures increased from $1.0 billion to $1.2 billion primarily due to higher spending at Disney Parks, Experiences and Products. According to the company, this increase was primarily due to cruise ship fleet expansion.

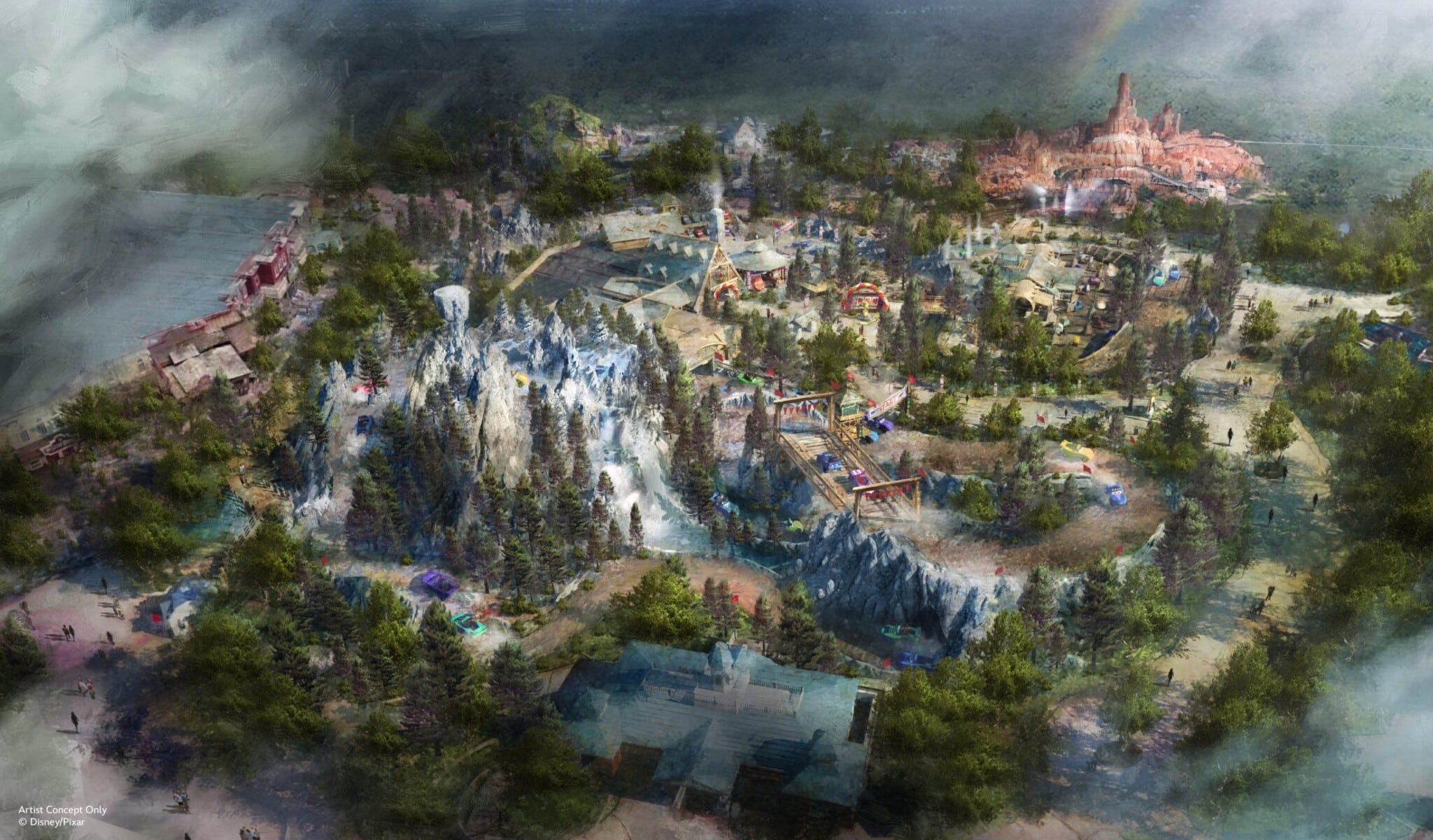

Work also continues on TRON Lightcycle Run at Magic Kingdom and they appear to be doing more digging in the Giant EPCOT Dirt Pit. For the international parks, the Zootopia expansion at Shanghai Disneyland, Arendelle: World of Frozen at Hong Kong Disneyland, and the expansion of Walt Disney Studios Park at Disneyland Paris are all ongoing.

During the Walt Disney Company’s earnings call Bob Iger shared more details about restructuring and spending reductions, announcing that Disney will be cutting $5.5 billion in costs. That will be made up of $3 billion from reductions in content, and the remaining $2.5 billion from non-content cuts. Disney executives said about $1 billion in cost cutting was already underway since last quarter.

Bob Iger also stated that Disney would be eliminating 7,000 jobs from its workforce, a decision that he did not take lightly. This amounts to about 3% of the roughly 220,0000 people that the Walt Disney Company employed as of the start of this fiscal year, according to an SEC filing.

This news doesn’t come as a huge surprise. It follows Bob Chapek’s memo to executives back in November that “tough and uncomfortable” cost-cutting decisions would be made, including a hiring freeze, layoffs, and other austerity measures. Shortly after returning to the helm, Bob Iger held a Cast Member Town Hall and was asked about that hiring freeze. “It felt like it was a wise thing to do in terms of the challenges, and at the moment, I don’t have any plans to change it,” Iger said at the time.

More recently, Bob Iger sent a return-to-work mandate. In our view, he did that to reduce headcount, trimming Disney’s number of employees without the unpleasantness of layoffs. It wouldn’t be the first time in recent history–Imagineering’s (supposed) relocation to Lake Nona would be different means to the same end.

As for what this means for Walt Disney World visitors…probably not much at all. If you’ve read even a few posts here over the last two years, you’ve likely heard us blame this or that on staffing shortages. They’re the reason characters have been slow to return, restaurants still aren’t offering all meal services, and so much more. Staffing shortages have become something of a boogeyman (except real) for which we’ve blamed many if not most of Walt Disney World’s operational shortcomings.

While improving tremendously, staffing shortages remain a key impediment to fully normal operations at Walt Disney World. The company has had tremendous difficulty filling certain key roles, and turnover is incredibly high–even as Disney hires aggressively, it has been losing employees almost as quickly as it can onboard them. As a result of this, Disney has left money on the table–because it has literally been able to fill tables at restaurants, offer a full slate of upcharge offerings, etc.

This comes even as attendance is continuing to increase at both Walt Disney World and Disneyland, with further gains expected in the coming quarter according to CFO Christine McCarthy. In short, it’s likely that the bulk of the 7,000 jobs being eliminated from the Walt Disney Company’s workforce are white collar office workers, and not frontline Cast Members. To the extent that they do occur at Walt Disney World or Disneyland, they’re more likely to be in the management ranks and, again, not Cast Members that staff attractions, restaurants, character meet & greets, etc.

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What do you think of Walt Disney Company’s Q1 FY2023 earnings and future forecast? Surprised that Disney+ lost 2.4 million subscribers and yet the stock price is still up after hours? What about the spike in per guest spending at Walt Disney World and Disneyland, or other theme park results? How are you feeling about the future of Walt Disney World, Disneyland, or the company in general now that Iger is back at the helm? Think things will improve or get worse throughout this year? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!