Disney and newly-returned CEO Bob Iger are facing a proxy fight from activist investor Nelson Peltz’s Trian Fund pushes for a seat on the company’s board. His group has launched a “Restore the Magic” campaign, which sounds an awful lot like a live-action Save Disney remake. This post delves into the details and offers our commentary about what’s in store as Iger squares off against Peltz.

Let’s start with brief background. For those who weren’t fans back then or have not heeded our many recommendations to read DisneyWar, SaveDisney was a proxy battle that began in 2003. Shareholders, stakeholders, and fans of Disney launched a campaign of concerns about the company’s performance and management, launching SaveDisney.con and undertaking a media blitz in the process.

The face of the Save Disney initiative was Roy E. Disney, the nephew of Walt Disney–who literally had a face that resembled his uncle. It was orchestrated by Roy and Stanley Gold, who were former members of Disney’s Board of Directors. These two felt that the company was not living up to its potential and that leadership changes needed to be made in order to improve performance and left to fight for change from the outside.

In particular, Michael Eisner lost the confidence of Roy E. Disney, with the latter believing Eisner was no longer the best person to run the Walt Disney Company. Roy had previously backed Eisner as CEO, but pointed to the untimely death of Frank Wells as a pivotal moment for Eisner, and the beginning of his unraveling as a leader. After that, Roy felt that the company had lost its focus, creative energy, and heritage.

The Save Disney campaign focused on several key issues, including the company’s management, strategy, and financial performance. Roy E. Disney and Stanley Gold criticized the company’s core values and strategy, arguing that Disney had become too focused on short-term financial goals at the expense of long-term growth and legacy.

Among other thing, the SaveDisney campaign pointed to Eisner’s failure to manage ABC programming and achieve key metrics at the company’s television networks. They also zeroed in on Eisner’s leadership–or lack thereof–which had resulted in creative brain drain with the loss of talented employees, as well as his refusal to establish a clear succession plan.

They also focused on weak investments in the theme park business, pointing to building Disney’s California Adventure, Hong Kong Disneyland, and Walt Disney Studios Park in Paris “on the cheap.” In addition to that, the consumer perception that the company is constantly looking for the “quick buck” rather than the long-term value, resulting in brand damage and loss of trust.

Occurring during the nascent days of the internet and online activism, the Save Disney campaign garnered attention among fans and shareholders thanks in large part to its impassioned website. The initiative was likewise successful in generating significant media coverage and in building public support. It became too big to ignore, and in the end, Eisner was stripped of his chairmanship before voluntarily resigning as CEO (a face-saving measure, to be sure).

Consequently, Bob Iger was named the successor CEO, and Roy and the company agreed to put aside their differences. The SaveDisney domain closed, publicity tour ended, and Roy rejoined the company as a Director Emeritus and consultant. With that, Iger made good on many of the stated goals of the Save Disney campaign. He invested significantly in the parks, acquired Pixar, and more.

Fast-forward almost twenty years later, and there’s a new proxy fight that bears a striking resemblance to the Save Disney campaign. Late last year, Nelson Peltz’s Trian Group took an approximately $900 million stake in Disney and began pushing for a board seat. At that time, Trian indicated it was seeking operational improvements, while it also opposed Bob Iger’s return as Disney’s CEO.

In the last week, this has intensified into a bona fide proxy fight. Trian Group filed a preliminary statement with the aim of putting Peltz on Disney’s Board of Directors. In that, Trian noted that it had met with various Disney leaders and board members, beginning with then-CEO Bob Chapek last summer. As basis for the battle, Trian pointed to poor corporate governance, failed succession planning, over-the-top compensation, and misguided spending and growth strategies at Disney.

In a likely attempt to preempt what could be a brutal battle with Peltz and Trian, Disney announced that Mark Parker would become the new chairman of the board and lead a newly-formed succession planning committee. As previously reported, Parker was once considered an interim CEO candidate (and in our view, should also be a future CEO candidate).

Shortly thereafter, Trian launched its “Restore the Magic” website and PR blitz, with Peltz making multiple appearances and doing interviews with financial media, speaking with CNBC’s Jim Cramer and several others. During those, Peltz has referred to his slide presentation on Disney’s many failures under both Chapek and Iger. Summarizing his issues with the company, Peltz has pointed to Disney’s poor share performance, noting that the stock currently trades near its eight-year low.

In that slide deck and on the Restore the Magic website, Trian makes a more detailed and nuanced case. While acknowledging that the pivot to streaming has been difficult for many media companies, Trian contends that many of Disney’s struggles are self-inflicted.

Trian also indicates that it is not attempting to create additional instability by replacing Bob Iger. In addition to not calling for Iger’s ouster, Trian is not pushing for the selling of ESPN or other TV assets. Rather, the group contends that Disney is at a crossroads and needs to make significant changes to position it for sustainable, long-term growth and success. Trian argues that it could help the company achieve this goals either via collaboration or the addition of one qualified addition (Peltz) to Disney’s Board of Directors.

Although I’ve watched multiple interviews with Peltz, I think he pleads his case far better in the slide deck than via interviews, so that’ll be the focus of this analysis. The slide presentation starts with background about Trian and Peltz, which aims at preemptively addressing characterizations that he’s a corporate raider or simply looking to cut corners to squeeze even more profitability out of the company.

It’s a persuasive argument, and one that is also corroborated by third party reporting. By most accounts, Trian has been successful in helping to turn around companies or at least improve their trajectories. For its part, Trian contends that it encourages management teams and boards to “operate as if wearing ‘bifocals,’ with a watchful eye on the near-term but always maintaining a primary focus on maximizing long-term value.” This orientation on the long-term value is an undercurrent of the presentation, and one likely to give it credibility with fans.

Following a rundown of Trian’s bona fides and case studies about its past successes in collaborating with other companies that had initially been proxy fight targets, Trian lays out its case for issues with Disney. The arguments boil down to three main categories: capital allocation, corporate governance, and strategy & operations.

The crux of the capital allocation argument is that Disney materially overpaid for 20th Century Fox, relying upon overly optimistic assumptions when valuing the business and how it would benefit Disney. Trian contends that the Fox acquisition is the proximate cause of many of Disney’s current problems. Among other things, this includes the elimination of the dividend.

Trian also points to a lack of proper succession planning, pointing to the recent Battle of the Bobs while also looking back further. In particular, Disney’s Board extended Bob Iger’s retirement date five separate times between October 2011 and December 2017, only to have him abruptly retire in early 2020.

The group also contends that several well-regarded CEO candidates left Disney, including Tom Staggs, Jay Rasulo and Kevin Mayer due to Iger’s repeated extensions. Beyond that, allowing him to stick around as Executive Chairman set up Chapek to fail. It’s pretty clear from this portion of the presentation that, even though Trian isn’t seeking Iger’s ouster, the group is not a fan of him. (Which also explains Disney’s strident opposition to Peltz having a seat on the Board.)

Much of the presentation also focuses on runaway spending with Disney+ and how it’s less cost-efficient than Netflix. This is despite

Disney’s best-in-class intellectual property and franchises, contrasted with Netflix’s lack of the same.

Trian argues that Disney+ started as a niche streaming extension of Disney’s franchise flywheel, but has rapidly shifted to the core distribution channel. That has resulted in Disney ramping up investment to drive new subscriber growth at all costs–but without the company laying out a financial rationale behind the strategic pivot, which has put significant stress on Disney’s balance sheet and cash flow.

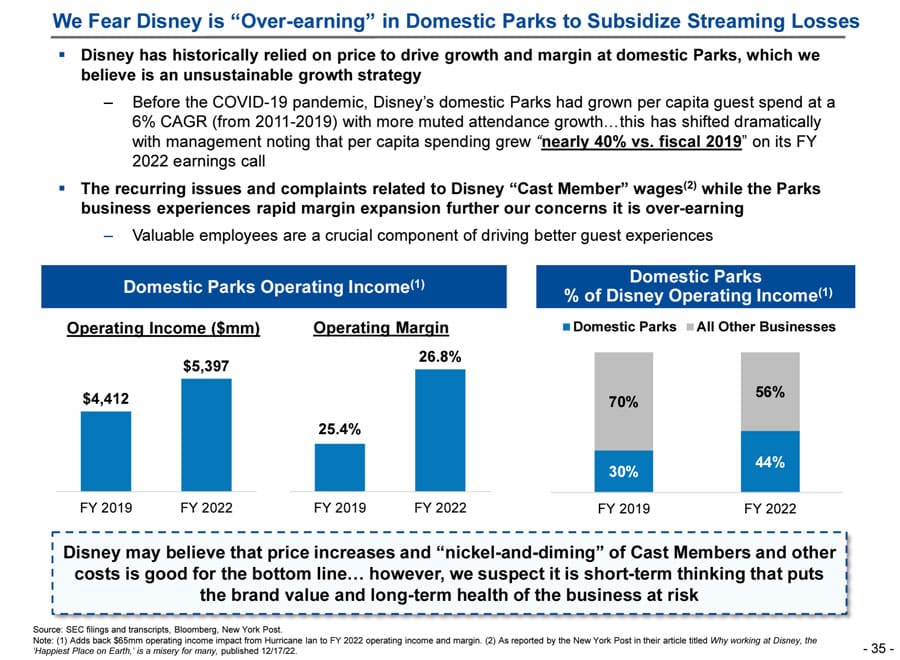

Finally, there’s the “good stuff” for readers of blogs like this one and fans of Walt Disney World and Disneyland. This slide is reproduced above so you can see Trian’s position in full. The group contends that Disney has historically relied on price to drive growth and margin at domestic Parks–an unsustainable growth strategy. Disney’s domestic Parks & Resorts had previously grown per capita guest spending at a 6% from 2011-2019, which spiked sharply to approximately 40% versus fiscal 2019 in the last two years.

Here, Trian’s core thesis is that price increases and nickel & diming is short-term thinking that puts the brand value and long-term health of Disney’s theme parks business at risk. I couldn’t have said it better if I wrote it myself. Oh wait, I have… many many many many many many times. Well, I couldn’t have said it more concisely. (Honestly, I think Trian should’ve been less concise, focusing far more on intangibles like this–especially if they want support from fans and Cast Members and not simply institutional investors.)

All of this will sound familiar if you’ve read fan blogs like this one, but also if you look back at the goals of the Save Disney campaign. History never repeats itself, but it often rhymes is very apt here. While some of the specifics differ (for example, streaming wasn’t a thing in the early aughts, but Disney’s broadcast strategy was similarly criticized), it bears striking similarities to Save Disney.

Honestly, this feels like one of Disney’s beat-for-beat live action remakes of a beloved animated film. Not nearly as good due it lacking the same heart and emotion, but one that will likely outperform at the box office (or in this case, on the internet) due to fundamental changes in the nature of distribution.

The heart and emotion that “Restore the Magic” lacks as compared to SaveDisney is the face of each campaign. Again, Roy E. Disney looked like Walt. Every time he appeared in interviews, it was a powerful visual reminder of the company’s rich creative legacy. It was impossible to ignore the reality that someone who looked like its visionary founder did not agree with the direction of the company.

Not only that, but Roy walked the walk and had incredibly strong support from animators and other Cast Members. He was beloved for arguably saving Disney once about a decade earlier, and the company’s best interests were core to his campaign. Disney and Eisner couldn’t really “hit back” in a way that resonated with the public.

There is no one alive today who can generate that same emotional response. There’s only one member of the Disney family who still has a relatively high profile, but she’s polarizing and unlikely to support this proxy fight.

Nelson Peltz does enjoy a powerful reputation among investors, but he too is controversial and has no chance of garnering the same widespread support as Roy E. Disney, son of Roy O. and nephew of Walt. In short, there’s no one who can step into Roy E. Disney’s shoes for an equally impactful Save Disney sequel. So we’ll have to settle for this heartless remake, I guess.

The thing about soulless sequels and remakes is that they still can have value. The same can likely be said for “Restore the Magic,” albeit in very different ways. For fans, I think the saying that (corporate) politics can make strange bedfellows is probably apt.

While Nelson Peltz is no T. Boone Pickens, fans will undoubtedly question his true motivations. Sure, the “Restore the Magic” website and slides talk a good game, but if there’s one thing with which Disney fans have intimate experience, it’s slick and misleading marketing that attempts to leverage emotion.

With that said, I see the “Restore the Magic” campaign as a positive for fans and the company as a whole. For one thing, it’s undeniably accurate in several regards. Succession planning has been a mess, Disney’s streaming strategy has chased Wall Street expectations and valuations, and the 20th Century Fox acquisition and accompanying debt is now an albatross for the company.

Then there are the contentions about the over reliance in Parks & Resorts, which have been “over-earning.” The last few years have undoubtedly reflected short-term thinking to drive profits and prop up the company’s numbers at the expense of long-term health and fan goodwill.

Specifically, I think the company and fans will benefit from this proxy fight, even if it’s ultimately unsuccessful, because it provides a meaningful “check and balance” on Disney. Consider this pitch along with the knowledge that this back and forth between Disney and Trian began over the summer when Bob Chapek was still CEO.

Those two things in tandem help recontextualize a lot of what has happened in the last several months. This definitely helps explains the very abrupt announcements of 3 BIG Changes at Walt Disney World to Improve Guest Experience & Value and Good Changes Coming to Disneyland: Park Hopping, Ticket Prices, PhotoPass & Annual Passes.

At the time, those announcements felt like CEO Bob Iger and Parks Chairman Josh D’Amaro following through on improvements they hinted were coming, and ways they disagreed with Bob Chapek’s approach to the guest experience at Walt Disney World.

In fact, we might go back even further, reassessing the leaks from Bob Iger’s camp in the aftermath of his return. It’s now possible to view much of that through the prism of this proxy fight with the benefit of hindsight. If we’re reassessing how the last few months have played out, we also can’t help but wonder if Disney’s Board of Directors brought back Iger to gear up for this fight, feeling that Chapek was not up to the task.

Frankly, some of that veers into conspiratorial territory. We’ve been raising the red flags on guest satisfaction and how D’Amaro and other leaders at Parks & Resorts have had their hands tied since early last year. The topic of damaging brand affinity and guest goodwill has been a hot topic for far longer, dating back to the first Iger regime. (Admittedly, it has gotten far, far worse in the last 3 years.)

In short, it’s highly improbable that this standoff with Trian and Peltz is the sole factor for any past, present, or future changes at Disney that undo past damage. Such a simple explanation would be convenient and easy to accept, but also reductionist and overlooking how this played out in real-time. Conversely, it’s impossible to dismiss this new proxy fight information as entirely coincidental–it almost certainly played a contributing role in what has played out thus far.

To that point, the proxy fight will almost assuredly prompt additional positive changes at Disney. Iger and the company do not want Peltz on the Board of Directors, and the easiest way to avoid that, ironically, will be voluntarily making some of the requested changes and improvements.

Among other things, this means reining in runaway spending on streaming content, clear succession planning, and deleveraging. For Walt Disney World and Disneyland, it also likely means more manageable price growth, less nickel & diming, and improved guest satisfaction. It also just might mean park expansion projects are given the green light, as a good faith showing that there’s long-term vision of the parks and they don’t exist to simply subsidize streaming losses.

Ultimately, this proxy fight strikes me as a good thing for Walt Disney World and Disneyland. There’s going to be an understandable skepticism among fans of an investor who is characterized as a corporate raider. That’s doubly true after years of corner-cutting in the parks and price increases aimed at meeting Wall Street expectations of quarterly gains.

However, this feels different. Based on the totality of the presentation, it appears to me like Trian is interested in the long-term health and viability of the business, and not just looking to make a quick buck. There’s an alignment of interests between fans and Trian and minimal downside risk to Peltz having a single seat on Disney’s Board of Directors–or at least pushing for one.

Honestly, I don’t really care whether Peltz succeeds or fails. While I’m receptive to his presentation and position, I’m also still slightly skeptical of his underlying motivations. His track record as demonstrated by Trian’s cited case studies is strong and positive, but Disney is also a very different beast.

Specifically, “lack of cost discipline” is a double-edged sword for creative companies, and one that gives me pause when it comes to Trian and Peltz. It’s fair to say that Disney is not equivalent to Heinz or Pepsi, and cost-cutting could very well undermine the core creative output.

It also doesn’t seem entirely fair to Monday morning quarterback the Fox acquisition; it definitely seems like Disney overpaid, but Iger had a strong track record before that with brilliant acquisitions. Disney would not be where it is today without his M&A prowess.

With all of that said, it’s the fight that has value for the company and Disney fans, not the eventual outcome. That will be especially true if Trian recalibrates its public-facing presentation to focus more on Cast Members and the guest experience (as they should–use different messaging for investors and fans) and shines a light on the long-term damage to the parks done since 2020.

The company has milked the Walt Disney World cash cow to the point that it was almost put out to pasture (to mix livestock metaphors) for many fans. Hopefully this proxy fight results in further reversal of that as the company seeks to undo damage from Bob Chapek’s Reign of Terror™️ while also undercutting Trian’s arguments for why it needs a board seat. We’ve already seen steps in the right direction from D’Amaro and Iger indicative of a foundational paradigm shift for the parks. Here’s hoping for more of that in 2023 as Disney attempts to fend off the proxy fight and win over Cast Members, fans, and long-term investors.

Need Disney trip planning tips and comprehensive advice? Make sure to read 2023 Disney Parks Vacation Planning Guides, where you can find comprehensive guides to Walt Disney World, Disneyland, and beyond! For Disney updates, discount information, free downloads of our eBooks and wallpapers, and much more, sign up for our FREE email newsletter!

YOUR THOUGHTS

What do you think about Trian’s “Restore the Magic” Campaign? Skeptical about that Nelson Peltz’s real motivations, or think he’s truly interested in long-term success? Think this will be as beneficial for the company as the SaveDisney initiative? Optimistic that this will push Iger to finally get serious about choosing a successor or focus on improving guest satisfaction in the parks? Think things will improve or get worse throughout 2023? Thoughts on anything else discussed here? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!