Bangalore, 6th September 2023: Axis My India, a leading consumer data intelligence company, unveils the latest insights from the India Consumer Sentiment Index (CSI), revealing noteworthy trends in consumer behavior. The report showcases a diverse range of data, such as the 3% decrease in overall household spending for this month compared to the previous month. Notably, 23% of respondents are anticipating increased shopping activities during the upcoming festive season, reflecting a positive sentiment towards holiday spending. Additionally, 44% of those intending to maintain their pattern of participation in e-commerce festive sales this year plan to spend more than last year. These numeric insights provide a quantitative backdrop to the evolving consumer landscape, guiding market strategies for the festive period.

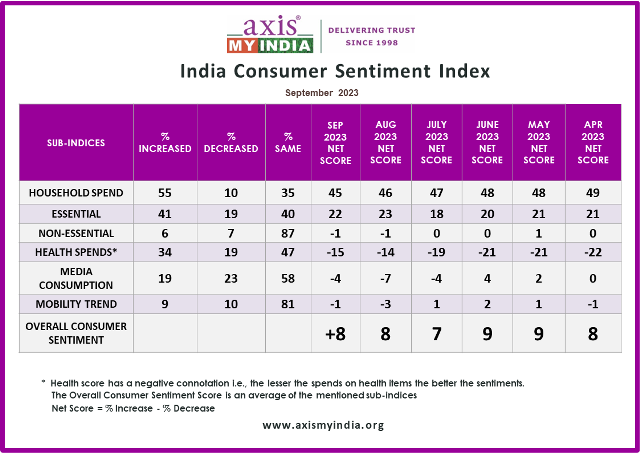

The September net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +8, which is same as last month (+8). However, the score reflects a dip of -2 from last year September 2022 (+10)

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey used Computer-Aided Telephonic Interviews and included 5048 participants from 35 states and UTs. Among them, 68% were from rural areas and 32% from urban areas. In terms of regions, 22% were from the North, 24% from the East, 28% from the West, and 26% from the South of India. Among the participants, 62% were male and 38% were female. Looking at the largest groups, 29% were aged between 36 and 50 years old, while 27% were aged between 26 and 35 years old

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said” “As we approach the festive season, our insights paint an encouraging picture for the retail landscape. A significant number of respondents are ready to elevate their shopping experiences, while others are poised to maintain their spending levels. E-commerce continues to play a pivotal role, with an increasing interest in festive online sales. This evolving trend suggests a promising market dynamic. As consumer preferences shape the retail arena, we anticipate a vibrant festive shopping spree ahead, reflecting a positive and forward-looking trend.”

Key findings

· Overall household spending has increased for 55% of the families, which is a decrease by 3% from last month. Consumption remains the same for 35% of families. The net score, which was +46 last month is +45 this month.

· Spends on essentials like personal care & household items have increased for 41% of families, which marks a decrease by 3% from last month. Consumption remains the same for 40% of families. The net score, which was at +23 last month has dipped to +22 this month.

· Spends on non-essential & discretionary products like AC, Car, and Refrigerators have increased for 6% of families, which is the same as last month. Consumption remains the same for 87% of families. The net score, which was 0 last month is at -1 this month.

· Expenses towards health-related items such as vitamins, tests, healthy food has surged for 34% of the families. This reflects an increase in consumption by 1% from last month. Consumption remains the same for 47% of families. The health score which has a negative connotation i.e., the lesser the spends on health items the better the sentiments, has a net score value of -15 this month.

· Consumption of media (TV, Internet, Radio, etc.) has increased for 19% of families, depicting a decrease in media consumption percentage by 1% from last month. The net score, which was -7 last month is at -4 this month. Media consumption remains the same for 58% of families.

· Mobility has increased for 9% of the families, which is an increase by 2% from last month. The net score, which was -2 last month has improved to -1 this month. Mobility remains the same for 81% of the families.

On topics of current national interest

· The survey delved into consumers’ intentions regarding their shopping preferences for the upcoming festive season. Notably, 23% of respondents plan to shop more during the festive period as compared to last year. Additionally, 28% of participants revealed their intention to maintain their spending habits at the same level as before, hinting at a stable consumer sentiment. These responses highlight the potential shifts in consumer behavior and their possible impact on the market.

· The survey explored respondents’ prior and potential involvement in festive sales organized by e-commerce giants like Amazon and Flipkart. Significantly, a notable 23% of participants confirmed their past participation in such events and expressed their intent to maintain this pattern this year as well. Additionally, 11% of those who had not engaged in festive online sales before expressed their interest in participating this year. Conversely, 7% acknowledged their previous engagement but revealed their decision not to partake this year.

· Of 23% of those who intent to maintain the pattern this year, 44% said they will be shopping more through e-commerce mediums as compared to last year. These insights provide a comprehensive understanding of consumers’ past and evolving attitudes towards e-commerce festive sales, shaping strategies for these platforms.

· The survey explored participants’ inclinations towards investment in the Indian stock market or other financial assets in the upcoming months. Notably, a mere 6% expressed an intention to invest more, while 10% indicated plans to invest less. Meanwhile, 5% are projected to maintain their investment levels. These insights provide a snapshot of the current sentiment towards financial market investments, emphasizing the diverse attitudes among the surveyed individuals. Notably, a significant 79% still don’t invest in stocks.

· The survey inquired about participants’ perceptions regarding the potential movement of the stock exchange (SENSEX) beyond the threshold of 70,000 before the festive period of Dussherra/Diwali this year. Encouragingly, 46% of respondents who invested expressed optimism that such a milestone could be achieved. Furthermore, 8% were uncertain about the market’s trajectory. These findings underscore the diverse range of opinions prevalent among respondents, reflecting the complex and multifaceted nature of stock market predictions.

· The survey delved into participants’ perspectives on the government’s economic policies and their perceived influence on the nation’s growth. Impressively, 64% of respondents expressed a confidence in the effectiveness of policies such as Pradhan Mantri Jan Dhan Yojana and Pradhan Mantri Mudra Yojana.

· The survey inquired about respondents’ awareness of the forthcoming 2023 ODI World Cup being hosted in India. Encouragingly, 70% of participants confirmed their awareness of this prestigious sporting event taking place in the country. It highlights the fact that a substantial majority of respondents are cognizant of the global cricket event’s occurrence on Indian soil, reinforcing the event’s prominence and reach among the surveyed audience.

· The survey sought to ascertain respondents’ preferences regarding their anticipated viewing platforms for the upcoming 2023 ODI World Cup set to unfold in India. The findings reflect a diverse array of choices. Notably, 47% of respondents expressed their intention to tune in via traditional television, utilizing DTH or cable services. Demonstrating the increasing influence of digital trends, 27% indicated their inclination to follow the event on their mobile devices. A notable 9% exhibited enthusiasm to experience the tournament live by planning to attend matches at the stadium. These preferences underscore the multi-faceted avenues through which individuals are gearing up to engage with the international cricket spectacle, embracing both traditional and contemporary viewing modes.