In a new SEC filing, the company revealed that it will spend $60 billion over the next decade to expand and enhance Walt Disney World, Disneyland, Disney Cruise Line, and its international theme parks. This represents nearly double the amount invested over the last 10-year period, which was a time of significant expansion, as Disney seeks to “turbocharge” its theme parks. This covers what was revealed in the SEC filing, statements from CEO Bob Iger and Parks Chairman Josh D’Amaro, plus our commentary.

This is the latest move in an ongoing story about the Walt Disney Company pivoting away from streaming and legacy media and signaling intentions to bet bigger on its theme parks, which have been the biggest bright spot during a dark year for Disney. It started earlier this year, during the Annual Shareholder meeting when Bob Iger said that Disney is “currently planning now to invest over $17 billion in Walt Disney World over the next 10 years. Those investments we estimate will create 13,000 new jobs at Disney and thousands of other indirect jobs and they’ll also attract more people to the state and generate more taxes.”

It has continued on several occasions since, with both Iger and D’Amaro hyping up the future of the parks and indicating that significant investment is on the horizon. The tone has been similar in California, where Disney has kicked its DisneylandForward sales pitch into high gear, hoping to get approval from Anaheim in the near future. All the while, many diehard Disney fans have been understandably skeptical about whether the company is sincere or if this is more bluster and hype without any substance. So let’s start by addressing that…

We’ve long “warned” fans against taking at face value everything Disney says in marketing materials. The company is incredibly adept at corporate communications, masterfully employing wordsmithery to excite fans. Disney always stays on the right side of the puffery versus false advertising line, but most fans recognize this for what it is and weigh marketing materials accordingly.

However, this was not a press release or even the recent Destination D23 fan event. This comes from a Form 8-K filing by the Walt Disney Company with the United States Securities and Exchange Commission. In this case, that matters a lot.

There are no rules about what Josh D’Amaro says on stage at Destination D23. Anything goes. He could go out there and slander the good name of Figment, claim that Dino-Rama is an exemplar of themed entertainment, or that CommuniCore Hall is going to blow your minds. Sadly, law enforcement officers could not rush the stage to apprehend him for any such remarks, however false and inflammatory.

But this is a legal filing with the SEC, and its rules prohibit companies from fraudulent, false or misleading statements to investors. This prevents Disney or any other company from releasing reports with inaccurate data or executives from making knowingly false claims that analysts and investors might rely upon.

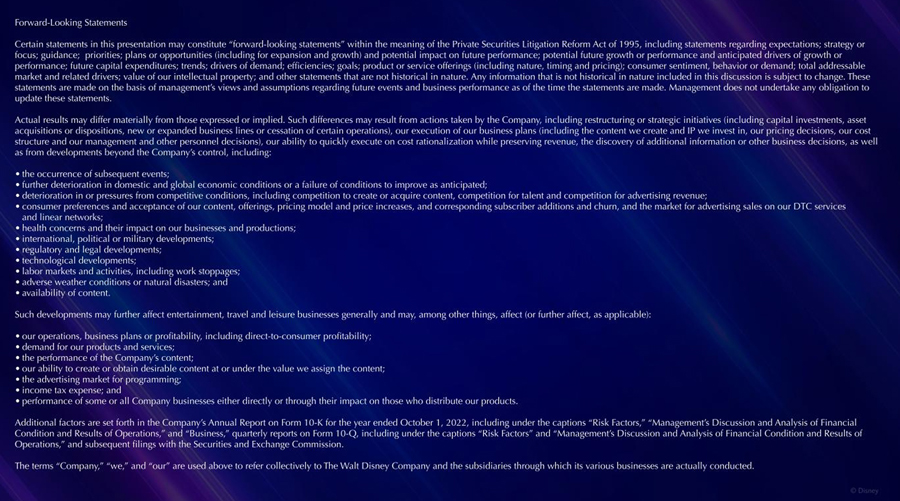

For its part, Disney tries to shield itself with a long disclaimer about forward-looking statements on its investor relations pages. There’s a lot of language there and it’s worth reading yourself, but the bottom line is that forward-looking statements are “made on the basis of management’s views and assumptions regarding future events and business performance as of the time the statements are made.”

However, circumstances and plans could change due to different strategic initiatives or other business decisions, as well as from developments beyond Disney’s control (see March 2020 or Wall Street’s shifting sentiment towards streaming). Yada yada yada.

The point is that that are legal standards for forward-looking statements and SEC filings; what’s here is the current plan but is subject to change as conditions evolve. In other words, you shouldn’t necessarily rely on an “announcement” about plans that are a decade out. Conversely, it’s not total nonsense meant to excite and hype up fans, either. In this context, that would literally be fraudulent.

In short, the Walt Disney Company would not make such a bold statement about investing $60 billion in Walt Disney World, Disneyland, Disney Cruise Line, and the international parks if that was not the company’s current plan, or if there were no viable financial means for accomplishing said investment over the course of the next decade.

Against that backdrop, here’s the statement that the Walt Disney Company provided to the U.S. Securities & Exchange Commission about its updated Capital Expenditures plans for its theme park business:

The Walt Disney Company is providing the following update regarding its plans for capital expenditures at its Disney Parks, Experiences and Products (“DPEP”) segment. The Company is developing plans to accelerate and expand investment in its DPEP segment, to nearly double, as compared to the previous approximately 10-year period, consolidated capital expenditures for the segment over the course of an approximately 10-year period to approximately $60 billion in aggregate, including by investing in expanding and enhancing domestic and international parks and cruise line capacity, prioritizing projects anticipated to generate strong returns, consistent with the Company’s continuing approach to allocate capital in a disciplined and balanced manner.

We believe that the Company’s financial condition is strong and that its cash balances, other liquid assets, operating cash flows, access to capital markets and borrowing capacity under current bank facilities, taken together, provide adequate resources to fund ongoing operating requirements, contractual obligations, upcoming debt maturities as well as future capital expenditures related to the expansion of existing businesses and development of new projects.

This statement is followed by a bunch of slides offering the bases for this aggressive investment–I’ll insert the most interesting of these throughout the commentary below.

In a separate piece in The New York Times, both CEO Bob Iger and Parks Chairman Josh D’Amaro released statements. “There are far fewer limits to our parks business than people think,” Iger told the NYT.

“The growth trajectory is very compelling if we do nothing beyond what we have already committed,” he continued, referring to attractions and ships that have been announced but are not yet operational. “By dramatically increasing our investment — building big, being ambitious, maintaining quality and high standards and using our most popular I.P. — it will be turbocharged.”

Josh D’Amaro addressed potential risks of betting big on theme parks, and pointed to the resilience of the theme park through past periods of uncertainty and turmoil. He noted that customers had come flooding back when Disney parks reopened during the pandemic.

“Every time there has been a moment of crisis or concern, we have managed to bounce back faster than anyone expected,” D’Amaro said.

When asked by the New York Times how Disney would spend the $60 billion, D’Amaro declined to offer specifics. He instead noted that Disney movies like “Coco,” “Zootopia,” “Encanto” and others had not yet been incorporated into the company’s parks in meaningful ways.

“Imagine bringing Wakanda to life,” he added. “In terms of bringing the latest Disney-Marvel-Pixar intellectual property to the parks, we haven’t come close to scratching the surface. And we have learned that incorporating Disney I.P. increases the return on investment significantly.”

As bullish as I am on the future of Disney Parks & Resorts (and if you’ve read any of my commentaries this year, you know I am very bullish), I’m also not convinced that the Walt Disney Company will spend $60 billion on Walt Disney World and Disneyland (etc.) in the next decade.

There are several reasons for this, with the very first being that the company quite simply has too much debt and not enough liquidity to front-load spending. This means that whatever the 10-year plan is for Disney’s Park & Resorts, it’s necessarily backloaded. As anyone who has been around the block with the original “Disney Decade” or the DCA expansion or the EPCOT overhaul or…well, about half of the announcements at the last few D23 Expos…the more remote the timeline, the less likely something is to come to fruition.

My guess would be that the company’s intention is to switch gears and focus on Parks & Resorts once Hulu and ESPN are sorted out (bought and/or sold), the streaming segment attains profitability or at least stops hemorrhaging hundreds of millions of dollars per quarter, and some of the debt is paid down.

Some or all of those things pretty much have to happen before meaningful CapEx can be spent on Walt Disney World. That alone puts the start of this work in late 2024 or 2025. This doesn’t mean Disney won’t announce big plans earlier, but we likely won’t see significant construction on anything until then.

I think it’s fairly safe to say that actual CapEx investments totaling $60 billion are currently planned for Walt Disney World, Disneyland, DCL, and the international parks over the course of a decade. But that spending probably doesn’t start in earnest until October 2024 or maybe even 2025.

If we had to break the next decade into 5-year segments, my guess is that even the current plan doesn’t call for $30 billion and $30 billion in each of those 5-years. It’s probably more like $20 billion and $40 billion, and with a disproportionate part of the $20 billion in the near-term being spent on cruise ships and the international parks. It’s also fair to say that’s the most optimistic projection, and a lot could change, potentially impacting and reducing that number.

Then there’s the thing that will change: Bob Iger won’t be CEO to see this through to completion. The good news, at least from my perspective, is that Iger will be there to start this spending, as the board recently extended his contract through December 31, 2026. I know there are a lot of Iger haters out there, but hopefully this proposal causes at least some of them to reevaluate and see him in a new light.

More meaningfully, it’s good that there will not be a CEO change prior to the start of this $60 billion investment. A new CEO always makes their mark on a company, and one of the easiest and most concrete ways to accomplish that is via theme park plans. If Iger were still leaving at the end of next year, I’d say it’s entirely possible that none of this comes to fruition, as the next CEO could simply change their mind and opt to invest elsewhere.

Another tangent, but I suspect this increases the likely of Josh D’Amaro being the CEO-in-waiting exponentially, as he’d provide continuity in these aggressive plans. (I still think the best approach is an Eisner-Wells type of scenario, with Josh D’Amaro or Tom Staggs paired with someone at the top who has media experience–Kevin Mayer, for example.)

With all of that said, we thought it might be worthwhile to put $60 billion in context to help illustrate what it could buy for Disney’s Parks & Resorts. Obviously, that’s a lot of money–especially when you consider the fact that the original Dino-Rama cost at least $437 to build. Its replacement will probably add a “million” to the end of that number.

We’ll start by putting this into the context of CapEx numbers for the Parks & Resorts segment as a whole, which includes Walt Disney World, but also Disneyland, Disney Cruise Line, the international parks, resorts, and more.

We’re going to discard the last few years. Some of the reasons for that should be obvious, given the disruptions and cost-cutting that has occurred with the EPCOT overhaul. There’s also the fact that one development cycle has been winding down for Walt Disney World, while the new cruise ships have been contributing outsized costs.

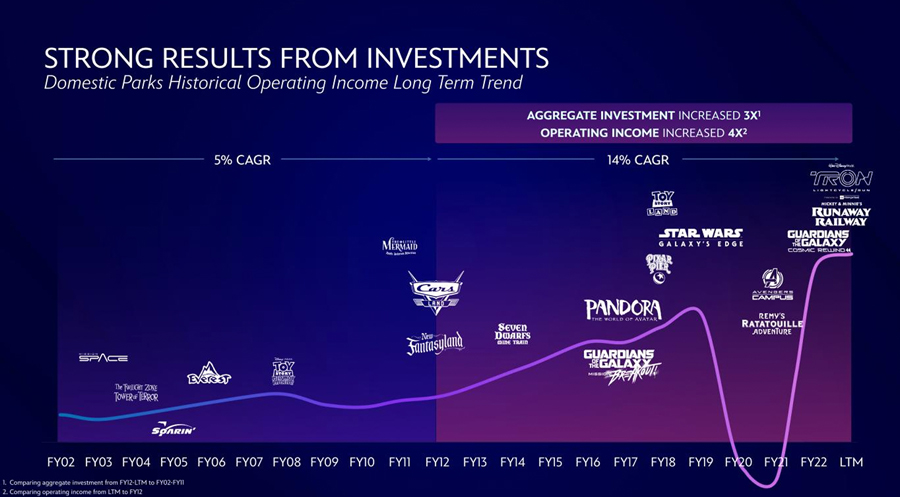

Instead, we’ll look at 2017-2019. That was during the peak of the most recent expansion and occurred at a time (mostly) prior to spending on the new DCL ships. In 2017, the company spent $2.4 billion on CapEx for the domestic Parks & Resorts. In 2018, that number increased to $3.2 billion. In 2019, it peaked at $3.3 billion. These are just the totals for the U.S. based Parks & Resorts, including Disney Cruise Line. There’s a separate line-item for the international parks (minus Tokyo), and the total costs in Hong Kong and Shanghai are shared by local operating partners.

In an SEC filing last year, Disney indicated that the company planned to increase total capital expenditures from $4.9 billion to $6.7 billion. That whopping 37% spending increase would’ve been across the entire enterprise, not just domestic parks. (Again, the new DCL fleet is the big near-term expense.) Unlike other divisions of the company, Parks & Resorts has not really been targeted for aggressive cost-cutting this year. And for good reason: they’re the company’s biggest bright spot right now!

As for what $60 billion over a decade could buy, let’s start with what we think it will not buy: we (still) do not expect a 5th gate at Walt Disney World. This has seen rekindled interest in the last year, but we’re still highly skeptical for all of the reasons discussed in that post.

Of course, this could be wrong. If you’re just having fun doing blue sky daydreaming, have at it. Personally, I’m skeptical that the company would opt for building a brand new theme park with all of the necessary infrastructure, rather than building out the existing gates. Not only that, but Disney has repeatedly signaled that expansion of the existing parks is the plan.

Regardless, $60 billion is conceivably enough for 5th, 6th, and 7th gates at Walt Disney World, in theory. That’s especially true if they cost as much as Tokyo DisneySea (~$4 billion upon opening in 2001) or Shanghai Disneyland (~$5.5 billion upon opening in 2016). If it’s the cost of Universal’s Epic Universe, Disney could build over a dozen new gates!

Speaking of which, it’s already clear that Disney won’t have any “answer” to Epic Universe when it opens in Summer 2025. They simply aren’t capable of building anything that quickly, so it’s already too late. About the best they can probably do is delay Tiana’s Bayou Adventure to 2025 or lean heavily on entertainment to attempt to counter Epic Universe.

I doubt many Walt Disney World fans want to hear this, but rightly or wrongly, Disney does not seem overly concerned with Epic Universe. This announcement is not fueled by fears about Universal–it’s due to the unrealized potential of the Parks & Resorts, and it being pretty much the only business segment that has overperformed.

I’ll also add that claims that Universal is going to “eat Disney’s lunch” are not even remotely grounded in reality. Average guests (infrequent visitors or first-timers) don’t experience destinations on the sole basis of what’s brand new. Nevertheless, as a hotel business that also operates theme parks, Walt Disney World cannot be comfortable losing overnight guests to Universal. Even a 10% reduction would be a big blow.

Back in realityland, a 5th gate at Walt Disney World probably would not cost that little unless it were done in the spirit of the OG Walt Disney Studios Park in France. Construction costs aren’t what they were in the early aughts in Japan or even a decade later in China. Disney doesn’t do anything nearly as efficiently as Universal.

On top of that, this is all of the CapEx over the course of a decade and it’s also for all of the Parks & Resorts businesses around the world, which means every theme park and hotel (minus Tokyo) as well as all of the cruise ships. We already know Disney Cruise Line is spending big in the near future, and it’s likely that there are more new lands on the horizon at Disneyland Paris and Shanghai Disneyland.

Suffice to say, maybe 30% of this $60 billion will be spent at Walt Disney World–or around $20 billion. Even if a new park could be built for $6 billion, that be a big chunk of that total, and would necessitate CapEx reductions in the existing 4 parks as compared to the last decade. Given that, there’s every reason to believe the plan is expansion to the existing parks rather than development of a new one (or two).

With that in mind, what could that $60 billion buy in terms of expansions to the existing parks? Well, beyond working backwards from the above nationwide numbers for past CapEx, it’s tough to say. Disney doesn’t typically announce the cost of specific attractions or lands, so all we have are rumors and estimates of those.

As a general proposition, take whatever you’d expect a new ride to cost and increase that number significantly. The amounts spent by regional theme parks or even Universal are not even remotely insightful for the exorbitant expenses Disney somehow manages to incur. (To everyone who thinks the company hasn’t been investing money in Walt Disney World, you are wrong. The real question is whether they’ve been spending the staggering sums wisely.) Some of this is evident in the finishing and details, but definitely not all of it.

Rumors pegged the total cost of Guardians of the Galaxy: Cosmic Rewind at around $500 million (corroborated by Bloomberg), which would make it one of the most expensive attractions ever developed. Some estimates put the entirety of Star Wars: Galaxy’s Edge at $1 billion (each); that was prior to completion, with development costs shared between the coasts, and before Star Wars: Rise of the Resistance was delayed. It would not surprise me in the least if each Galaxy’s Edge ended up costing closer to $1.5 billion when all was said and done.

Back in 2010, the Los Angeles Times reported that each version of the Little Mermaid dark ride would cost $100 million, which was viewed by fans as a staggering sum at the time but now seems decidedly average. Radiator Springs Racers reportedly cost over double that by the time Cars Land was finished. (The entire DCA overhaul was originally billed as costing $1.1 billion, but ballooned far beyond that.)

Outside of the United States, we have a better idea of specific attraction and land costs because other parks actually announce them. There’s been a lot happening in Japan over the last several years, and OLC releases specific budgets in its annual reports. From that, we know that the Tokyo Disneyland expansion that included Enchanted Tale of Beauty and the Beast, Fantasy Forest Theatre, and a Baymax spinner cost approximately $750 million US.

Of that total, it’s safe to say that one-third went to the Beauty and the Beast trackless dark ride. Perhaps more. If Walt Disney World could get a few dark rides of that caliber for $250 million each, they should! Animal Kingdom, EPCOT, and Disney’s Hollywood Studios could each use a high-quality family-friendly people eater.

On a similar note, there’s Fantasy Springs at Tokyo DisneySea. The total investment on that port and its accompanying luxury hotel will be approximately 250 billion yen, or around $2.3 billion US. This makes it the most expensive expansion for any existing theme park ever. (It’ll also allow Tokyo DisneySea to reclaim the crown as the most expensive theme park ever built.)

There’s also the all-new Space Mountain coming to Tokyo’s Tomorrowland in 2027 at an approximate cost of 56 billion yen. This is going to be a $400 million US attraction, and speculation strongly suggests it’s going to use the Cosmic Rewind ‘story coaster’ ride system, minus Marvel. (That checks out given the cost!)

Finally, there’s Treasure Cove at Shanghai Disneyland, which includes the most expensive opening day attraction at that park (Pirates of the Caribbean: Battle for the Sunken Treasure) and cost a reported $450 million US. It’s unknown what newer additions like Toy Story Land (definitely not as much) or Zootopia Land (probably about as much) cost.

That should offer a pretty good idea of what’s possible with $60 billion.

As for what might be built in California, I’d personally bet against anything having to do with DisneylandForward in the next decade. I know this is the thing for which so many Disneyland diehards are excited, but I’ll reiterate once again that this is mostly a long-term land use and zoning plan. All of the attractions and lands that have been teased with that aren’t actual plans, they’re placeholders.

The other reason I’d bet against that is because both Disneyland and Disney California Adventure have ample room for expansion and current lands that are overdue for updates. On the reimagining front, the big one is Tomorrowland…as has been the case for the better part of the last two decades. I’d be willing to bet that finally happens (famous last words).

In addition, there’s the Marvel Multiverse E-Ticket for Avengers Campus. Based on Destination D23, it seems like that’s still happening, but is further down the road. There’s also the Avatar Experience at Disneyland Resort, but who knows where that’s going, or what it even is. Finally, I think Fantasyland expansion is a pretty safe bet over the next decade. My gut says World of Frozen will be (more or less) cloned in California if it’s a success at Hong Kong Disneyland. It should be–it looks gorgeous.

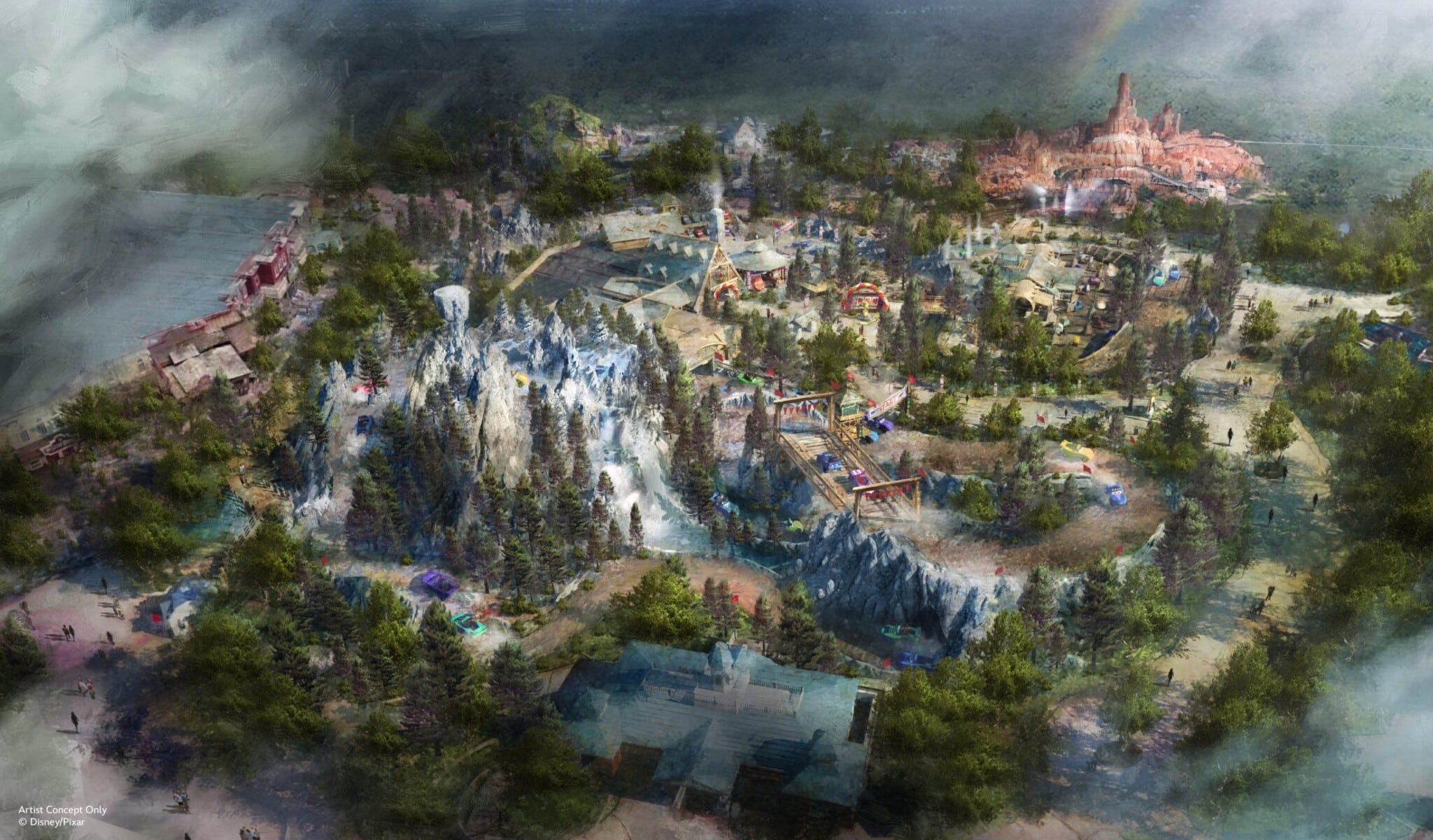

As for Walt Disney World, expect a big chunk of the expansion there in the next decade to be consistent with D’Amaro’s Destination D23 presentation earlier this month. During that, he discussed early concept explorations for Magic Kingdom and Animal Kingdom. The big thing of substance here is the Tropical Americas at Animal Kingdom Plan, which calls for Encanto, Indiana Jones, and maybe Coco to replace Dinoland USA.

That presentation also included a bold proposal for Magic Kingdom growth, albeit with shaky specifics–that portion was much more ‘blue sky’ in what it could entail. That presentation looked at Magic Kingdom Expansion Possibilities “Beyond Big Thunder”, but didn’t offer any specific franchises for that. (Based on process of elimination, we’re guessing this is now going to be Villains-themed…and also maybe Coco, but who knows what else.)

In our Rankings of ALL Walt Disney World Announcements & Destination D23 Report Card, we expressed a lot of optimism about D’Amaro’s presentation, most of which was not shared by other fans. Suffice to say, there’s a lot of skepticism about these possible plans, especially in light of Disney’s not-so-stellar track record in building things that were “firmly” confirmed at past D23 Expos.

I have no clue what else might be on the horizon for Walt Disney World, but I think expansion at the two ‘kingdoms’ consistent with those teased plans, plus a new family-friendly attraction or two in Disney’s Hollywood Studios is likely. Given that D’Amaro mentioned it, maybe we’ll finally see the Black Panther redo of Rock ‘n’ Roller Coaster, or perhaps it’ll take over the abandoned plans for the Play Pavilion at EPCOT.

Personally, I would love nothing more than to see a second phase to the EPCOT overhaul that includes Journey into Imagination, but I won’t let my desires cloud my judgment as to what’s likely. Disney might deem EPCOT “done” at the end of 2023. (Even if they do, attendance and guest behavior will likely dictate otherwise within a few years.)

Everything else will likely be less exciting. There’s no way Walt Disney World goes through another development cycle without adding significant hotel and timeshare capacity. There already have been rumblings that Reflections – A Disney Lakeside Lodge is on again, and I’d expect confirmation of that before the end of this year. Maybe before the end of this fiscal year, even.

Infrastructure costs also aren’t cheap, and some of the numbers I’ve heard for recent roads and other work are shockingly high. I doubt Skyliner expansion is being seriously considered, and I certainly hope another boondoggle like the NextGen/MyMagic+ initiative isn’t. Disney needs to build actual attractions, not waste money on smoke and mirrors.

Ultimately, our view is that it’s time for the persistent pessimism to give way to optimism when it comes to the future of Walt Disney World. We’ve been bullish since last year’s D23 Expo, and while a lot has changed since, our sentiment and the underlying reasons for it remains the same. It also helps that Chapek is gone and both D’Amaro and Bob Iger have repeatedly expressed bullishness on big expansion at Walt Disney World. Sure, we still don’t have concrete plans, but all of these teases would not be happening if this were purely bluster or good PR.

Obviously, actions speak louder than words, and it might be hard to take these claims at face value given all of the scaled back plans, cancelled projects, and the fact that it took how many years to clone a short roller coaster in an empty warehouse. That’s fair. There’s also the reality that Walt Disney World continues to outperform, and investors have begun to take notice of its success. This coupled with Wall Street souring on streaming means Disney may finally start to bet bigger on its theme park business.

In light of all that, it truly feels like we’re standing on the precipice of the next big development cycle that will once again start at Animal Kingdom (just like the last one!) and play out in this same fashion with major new additions to each park coming online between 2026 and 2031. Let the Disney Decade 2.0 begin!

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What is your reaction to the Walt Disney Company’s SEC filing indicating that it plans to “turbocharge” investment and double CapEx to $60 billion on Walt Disney World, Disneyland, DCL, etc. in the next decade? Think this can be reconciled with the near-term cost-cutting or the company’s debt load? What potential plans or projects have you most and least excited? Anything you’re hoping does not end up coming to fruition? Do you agree or disagree with our assessments? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!