The Southwest Companion Pass allows a family member or friend to fly for free with the passholder on all flights. That’s right, it’s essentially a travel hack to unlimited half-priced flights, and is a great way to make frequent long weekends at Walt Disney World less expensive when paired with an AP. This guide to Southwest Airline’s Companion Pass covers how to get it, which is easier than you might think!

Let’s start with the nuts and bolts about how the Southwest Companion Pass works once acquired. Once you have the Companion Pass, you designate a traveler who will you use it (in most cases, your partner–but you’re not limited to husbands, wives, or other family members), and then any fare you buy or book with miles on Southwest Airlines (SWA) comes with a free fare on the same flight for that companion. There are still a small amount of taxes and fees they’ll have to pay, but that only amounts to ~$6 on most airfare.

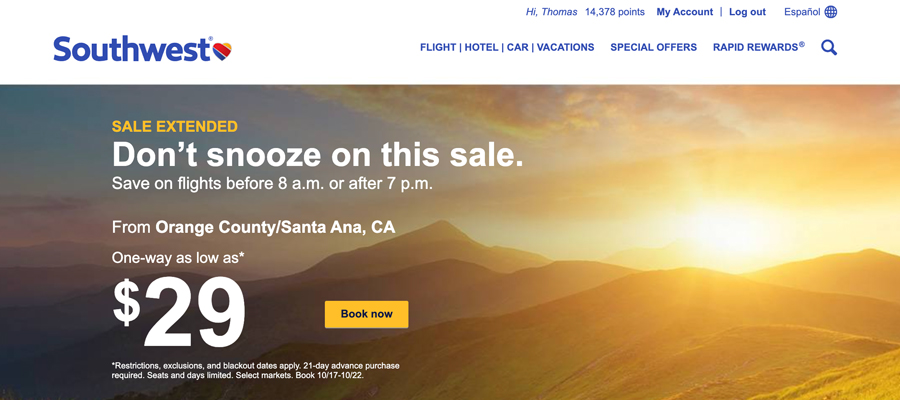

So let’s say you book a fare for $99 from Chicago to Orlando. Your companion flies for free, meaning that you’re essentially getting half-priced flights for both of you (buy one, get one free). With Southwest’s many ‘Wanna Get Away’ sales, you could pay even less. In fact, there’s currently a sale on flights before 8 a.m. or after 7 p.m., starting at $29–meaning you could be paying ~$15 per person to fly! (Not so coincidentally, that sale is what prompted this post, as I love redeye flights and late returns to maximize the park time during those long weekend trips to Walt Disney World!)

Back to the basics, there are a bunch of little rules and quirks that make the Southwest Companion Pass even more advantageous. As noted above, you can designate anyone as your companion. However, you can also change your SWA companion up to three times by calling Southwest Rapid Rewards. (We’ve never done this, but have friends who have strategically used their allotted changes to use the Southwest Companion Pass to travel with different people.)

The true value of the Southwest Companion Pass comes down to its restrictions. Or rather, lack thereof. Many of you are likely fans of SWA because it’s family friendly and doesn’t cater to business travelers like the legacy carriers. Well, same idea applies here. The Southwest Companion Pass can be used an unlimited number of times and it is not subject to any special fare class limitations. Meaning that as there is a seat available for sale on the plane, you can use it for the cheapest cash fares or Rapid Rewards points redemptions.

In other words, the Southwest Companion Pass is NOT one of those illusory “discounts” that allows you to “save more” by spending more. Walt Disney World dealhounds should know this game quite well, having seen not-so-special offers that require the purchase of full priced tickets or accommodations in order to qualify for Free Dining or some other perk. With the Southwest Companion Pass, you can spend as little as possible and still save. I’ll be honest with you–it becomes like an addictive challenge to maximize your savings and beat your past “scores.”

All of this probably sounds too good to be true, or like there’s a big catch coming. Perhaps that you only can qualify for the Southwest Companion Pass by repeating some ridiculous feats of strength or spending a boatload of money with SWA. No, you don’t need to fly in the middle seat for 124 consecutive flight segments or purchase $33,000 worth of in-flight food & beverages.

To be sure, there are ways to qualify for the Southwest Companion Pass that are more “traditional.” The two methods advertised on SWA’s site are flying 100 qualifying one-way flights in a calendar year, or earning 135,000 Rapid Rewards points in a calendar year. Obviously, those are big hurdles. Even as a frequently-flying blogger, I’ve never hit the requirements the “honest” way. (Not to say the alternative is dishonest–since SWA is not aimed at business travelers, I’m guessing it’s how more than 90% of travelers qualify for the Companion Pass.)

Instead, what we’ve always done is open two Southwest Chase credit cards, one personal card and one business card (something as pedestrian as selling on eBay qualifies you for a business card). I probably lost a decent number of you right there, as I know many people have this intense hatred for credit cards.

I’m not going down the road of debating whether credit cards are an evil device created to line the pockets of wealthy financial institutions or are great tools that enable you to obtain benefits for the money you spend everyday, anyway. All I will say is that since we’ve held our first credit cards, the two of us have received tens of thousands of dollars in rewards, and I have never paid a single cent in interest…all without making any Faustian Bargains!

We’ve never taken the time to calculate the value of what we’ve obtained via credit card rewards, but it’s easily over $100,000 at this point. I wouldn’t be the least bit surprised if it were actually closer to $250,000. We first started credit card hacking when we were freshly out of college, didn’t have much money, and leveraged credit card rewards heavily to do aspirational traveling that otherwise would’ve been out of reach.

In its early years, this blog might as well have contained a PBS-style disclaimer reading, “this project is made possible by a generous grant from the fine folks at Visa and American Express.” Those credit card companies didn’t know they were funding very important research into cupcakes and park touring strategy, but I’d like to think they would’ve supported the cause regardless. But I digress.

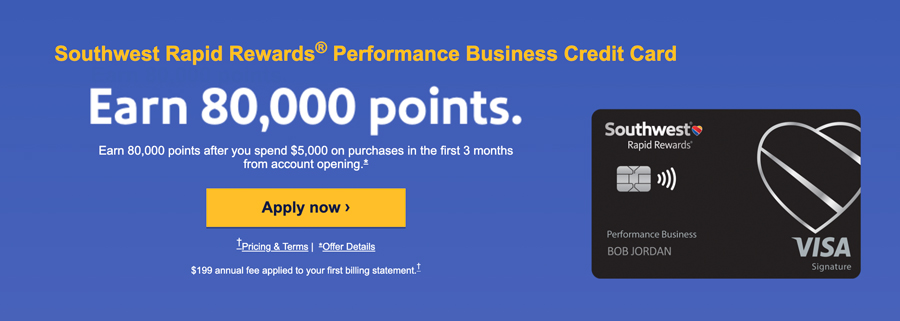

Cutting to the chase, from Chase Bank you can currently get for the Southwest Performance Business credit card with a sign-up bonus of 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening. (You can earn these bonuses via our referral link.)

Along with that, get any of the three personal SWA credit cards. (I’d opt for the bottom tier, as it has the lowest annual fee and this card is going to be largely redundant to the Southwest Performance Business card, anyway.) With any of those, you earn 50,000 points after you spend $1,000 on purchases in the first 3 months from account opening.

In tandem, you will earn over 135,000 Rapid Rewards points once you meet the minimum spend. (Bonus points of 130,000 plus spending of at least $6,000.) With the holiday shopping season right around the corner, now might be a good time to meet this spending goal. Or, you could book your 2024 Walt Disney World vacation or on discount Disney gift cards. Regardless, it is very important that you hit your spending goal strategically.

The Southwest Companion Pass is good for the full calendar year after the year you earn it.

This means that a Companion Pass earned in December 2023 expires on December 31, 2024 because you earned it this year. By contrast, a Companion Pass earned in January 2024 would expire on December 31, 2025.

That’s almost a full year of extra use simply by ensuring that you don’t hit the spending requirements until after your December statement closes, so that the points are posted in January 2024. If you’re savvy with spending, you can get the Southwest Companion Pass by January 5, 2024 and keep it until December 31, 2025!

One important thing to keep in mind here is Chase’s 5/24 rule. With this, you won’t be able to get most Chase cards if you’ve opened five credit card accounts across all banks in the past 24 months. Qualifying for the Southwest Companion Pass via credit cards and signup bonuses necessarily knocks out 2 of your 5.

If you’ve read the post to this point, that’s probably not a concern for you. The Chase 5/24 rule is aimed at hardcore hackers (or, I guess, serial spenders), who are not the target audience of this post. Still, if you’re considering getting into the wonderful world of travel hacking and are more inclined to fly internationally and on other airlines, you should give serious consideration to whether you want to burn 2 of your 5 cards on Southwest Airlines.

If you’re a couple or family primarily traveling to Walt Disney World or Disneyland, the Southwest Companion Pass is pretty much a no-brainer. There are few signup bonuses with as much potential as this one–the ‘value ceiling’ on the Southwest Companion Pass is incredibly high!

Some of you might have obvious use-cases for the Southwest Companion Pass. Others might be wondering whether this is for you, and how you’d leverage this to its fullest. Allow us to be ‘bad’ influences…

We’ll once again offer another plug for the 10 Best and 10 Worst Weeks to Visit Walt Disney World in 2023 to 2025. Critically, this combines quantitative and qualitative considerations when determining when to visit, and encompasses a range of dates.

In particular, we’d recommend the ones that include the following:

- 2024 EPCOT International Festival of the Arts (our favorite EPCOT event!)

- Start of 2024 EPCOT Flower & Garden Festival (our third-favorite EPCOT event–also a great time of year for an escape from cold weather!)

- Post-Easter (great weather and low crowds)

- Mid-September (very low crowds, Halloween + Food & Wine, miserable weather)

- Post-Thanksgiving (100% Christmas, great weather, low crowds)

Of course, that’s just Walt Disney World. We really should put together a similar best & worst weeks post for Disneyland. For now, here’s what we’d target:

- Lunar New Year (low crowds & cool weather)

- Food & Wine (same)

- Early Halloween

- Early Christmas

The first couple of times we had Southwest Companion Passes, we also went hard on seeing the U.S. National Parks and cities we had never visited. Among these were Acadia National Park (for fall colors), Rocky Mountains National Park, San Francisco and Pinnacles National Park, Yosemite National Park, Great Smoky Mountains National Park, Grand Canyon National Park, and others I’m probably forgetting.

Obviously, everyone has different interests–the salient point is that there’s a lot to see in the United States, and you don’t need to use the Southwest Companion Pass just on Walt Disney World or Disneyland. As revenge travel comes to an end everywhere, there are likely to be great deals across the board–including on airfare–making the next couple of years a great time to have this pass.

We speak from experience, as we first got the Southwest Companion Pass on the backside of the Great Recession. I still have spreadsheets with travel costs from back then and, holy cow, were some of those trips cheap!

With that in mind, we should also share our story with the Southwest Companion Pass paired with a Walt Disney World Annual Pass to serve as a cautionary tale. It was ~15 years ago and we lived in the Midwest, already visiting Walt Disney World a couple times per year. Annual Passes were a fraction of their current price, but so too were regular tickets (and the no-expiration option still existed then).

Once you have the Southwest Companion Pass in hand, you will use that “free” airfare to justify even more trips. Trust us. You get a ‘wanna get away’ email with discount airfare from SWA, and book a quick 3-day visit. Expensive as they are now, you buy an Annual Pass, justifying it on a per-day cost basis and on the resort discounts it’ll get you.

You start doing D23 and other niche events. You book trips just for soft openings or AP previews. A few long weekend trips per year turns into being at Walt Disney World every month. “Needing” to save even more money on accommodations, you join Disney Vacation Club. You get super-into photography and start a blog to expose the world to all of your crazy thoughts and obsessions. (Okay, perhaps that last very specific example is not universally applicable!)

It’s a slippery slope and qualifying for a Southwest Companion Pass to save money might end up costing you much more money in the long-term. It might also increase your happiness and quality of life. We speak from experience on all of this. So do with this information what you will.

Joking aside, getting the Southwest Companion Pass in our newlywed years was one of the best decisions we’ve ever made. Yes, it did lead to more trips to Walt Disney World and Disneyland, along with all of the above, which in a roundabout manner also unleashed all of my rambling thoughts on the internet. But it also allowed us to see the United States and have many memorable experiences together that shaped our relationship and who we are.

Not to end this on a sappy note or anything, but we’re firm believers in the value of travel to expand horizons, learn about the world and yourself. The Southwest Companion Pass is a great conduit for all of that. And to be clear, this blog is not actually funded by a generous grant from Chase Bank, Visa, The Walt Disney Company, or Southwest Airlines (…yet?). We’re just really passionate about travel and see the value it has had in our lives. With or without this, we’d encourage everyone to travel more–even if that means Megabus $1 fares, taking the train somewhere new, etc!

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

Have you ever had the Southwest Companion Pass? Did you earn it the ‘honest’ way or take advantage of credit card hacking to obtain it? Are you a fan of SWA or do you prefer other low cost or legacy carriers? Will you try for Southwest’s Companion Pass in 2024-2025? Do you agree or disagree with our advice? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!