The Walt Disney Company has reported its full year and fourth quarter fiscal 2023 earnings, beating earning expectations while falling short of revenue forecasts, while greatly exceeding Disney+ subscriber numbers. This covers the good & bad of these results as they related to Walt Disney World & Disneyland, and why despite the strong headline performance for parks, attendance and resort reservations are both down.

The newly-rebranded “Experiences” segment (formerly Disney Parks, Experiences and Products or DPEP, which was Disney Parks & Resorts prior to that…which is what we still call it) revenues for the quarter increased 13% to $8.16 billion. For the full year, Experiences revenue hit a record $32.5 billion, up 16% as compared to $28.1 billion in the prior-year (which was itself a record).

Disney reported net income of $264 million, or 14 cents per share, for the quarter, up from a net income of $162 million during the prior-year period. The company also stated that it plans to continue “aggressively managing” its cost base, increasing its cost-cutting measures that began at the beginning of 2023 by an additional $2 billion to a new target of $7.5 billion.

We’ll circle back to Parks & Resorts as we dig into the earnings report and call, but we want to start with the elephant in the room: streaming. Disney+ added nearly 7 million core subscribers in the fourth quarter, for a total of 150.2 million subscribers. This smashed expectations, as Wall Street had anticipated a total of 148.15 million Disney+ subscribers for the quarter.

Iger singled out key streaming content in the quarter that included theatrical titles Elemental, Little Mermaid, and Guardians of the Galaxy Vol. 3. Disney’s earnings report also mentioned the original series Ahsoka and the Korean original series Moving. (I’m pleased to see the success of Elemental. As someone who is sick of remakes, reboots, sequels, and cinematic universes, I want original ideas to succeed–and for more of them to be made. More of this–less of the live action remakes!)

Most importantly, Disney’s direct-to-consumer (streaming) division narrowed its losses considerably. The prior-year quarter was brutal, when streaming losses peaked at $1.4 billion. That was the infamous earnings report following which Wall Street Cut Disney’s Stock Price & Jim Cramer Called for Bob Chapek to Be Fired. It led to Chapek’s ouster only a few weeks later.

This quarter, Disney’s streaming services lost almost $1 billion less–only $420 million. That led to Iger taking a preemptive victory lap on CNBC before the call, and has the stock up ~3% in after hours trading. (Let’s not get too excited. Disney is still down year-to-date and is the target of another proxy fight from activist investor Nelson Peltz.)

Regardless, streaming is starting to look good. Losing money was always the plan with Disney+ as the company focused first on user acquisition and taking market share from Netflix (and preventing new market entrants from eclipsing them). Disney was largely succeeding at that, but spending got a bit out of control. That was at the behest of Wall Street, which wanted more growth and spending. Until it didn’t. (As previously noted, we’re critical of Chapek for a lot of things, but not the Disney+ approach–he was playing the cards he was dealt during the pandemic.)

In any case, Disney once again reiterated that the company continues to expect that its combined streaming businesses will reach profitability in Q4 of FY24, although progress may not look linear from quarter to quarter. Even if you couldn’t care less about streaming, all of this is huge, as Disney+ (etc.) attaining profitability frees up money for investment in Parks & Resorts. As we’ve said repeatedly, that’s a necessary prerequisite prior to investment in Walt Disney World or Disneyland.

To that point, Disney stated that it expects to “grow free cash flow in fiscal 2024 significantly versus fiscal 2023, approaching levels last seen pre-pandemic. This continued robust free cash flow growth, alongside our strong balance sheet, will position us well to address our investment and shareholder goals for the year and going forward.”

In plain English, this is Disney saying that it’ll soon have the ability to follow-through on its Plans to Double Investment to $60 Billion in Disney World, Disneyland & Beyond. More on the CEO’s and interim CFO’s thoughts about that in a bit.

Turning to Parks & Resorts, the company reported that operating income increased by over 30% versus the prior-year quarter, with year over year growth across all international sites, Disney Cruise Line, Disney Vacation Club, and Disneyland Resort. Anyone notice the (literally) ONE thing that’s missing?

The company once again reported a decrease at Walt Disney World due to lower guest spending driven by a decrease in average daily hotel room rates, wage inflation, and challenging comparisons to the prior year from the 50th anniversary celebration. The increase in costs was attributable to inflation and accelerated depreciation related to the closure of Star Wars: Galactic Starcruiser, for which the company is taking a write-off of $300 million in the last two quarters of this fiscal year.

None of this is particularly surprising. For one thing, it’s almost identical to last quarter, when Walt Disney World reported both lower attendance and resort occupancy year-over-year. For another thing, we’ve been documenting the slowdown in crowds at Walt Disney World. There’s been a lot of skepticism about this, but attendance absolutely is down year-over-year. Wait times and the company’s own financials corroborate this.

Finally, Walt Disney World has been releasing more (and better) discounts, which the company does not release out of generosity. This is something we’ve also documented, and it’s actually gotten more aggressive in the start of the 2024 fiscal year. For many dates this holiday season, there were no general public discounts for the last 3 years–this year has seen the best room discounts for October through December since 2018. The only thing missing has been Free Dining, which is probably best explained by the lack of the Disney Dining Plan, period.

This also isn’t the first, second, or even third time the company has directly addressed the decline at Walt Disney World and indicated that pent-up demand has been exhausted. No, the parks are not dead or ghost towns or totally empty, but they’re absolutely down year-over-year.

The company previously attributed the drop-off at Walt Disney World largely to pent-up demand exhausting itself for the Florida parks first since the state reopened earlier. By contrast, California and the international parks, as well as the cruise industry didn’t see a tourism rebound in earnest until roughly a full year later, so they are still benefiting from lagging pent-up demand.

So none of this is really cause for concern, or suggests foundational issues with Walt Disney World that don’t exist with the other Parks & Resorts businesses. It’s almost entirely a matter of timing mismatches. Walt Disney World overperformed relative to the other parks in 2021-2022, and now it’s underperforming relative to those record numbers as pent-up demand is exhausted for Florida.

It’s also worth pointing out that every key metric is still up as compared to pre-COVID. Numbers for Walt Disney World are just down as compared to last year, which is a tough comparison.

With regard to the aforementioned $60 billion investment in Parks & Resorts, interim CEO Kevin Lansberry addressed this while discussing the Experiences results. He stated that Disney expects those investments to “ramp up towards the back half of that 10-year period, with more gradual increases in the first few years.”

Lansberry also pointed out that, historically, CapEx for the Parks & Resorts is effectively self-funded given the strong returns these generate over time. He also noted that a portion of whatever investments are made in Shanghai Disneyland and Hong Kong Disneyland are funded out of joint venture cash flows, meaning Disney pays (roughly) half of the total cost.

None of this is surprising, either. As we’ve pointed out repeatedly, Disney has too much debt and not enough liquidity to front-load spending. This means that whatever the 10-year plan is for Disney’s Park & Resorts, it’s necessarily backloaded. This is precisely why figuring out streaming, ESPN, linear television, etc., are all integral to the future of Parks & Resorts.

That alone puts the start of this work in late 2024 or 2025. This doesn’t mean Disney won’t announce big plans earlier, but we likely won’t see significant construction on anything until then. Spending probably doesn’t start in earnest until October 2024 or maybe even 2025. That’s the point at which we’d expect work to begin on the Tropical Americas at Animal Kingdom, meaning you probably have (at least) another year to ride Dinosaur.

If we had to break the next decade into 5-year segments, my guess is that even the current plan doesn’t call for $30 billion and $30 billion in each of those 5-years. It’s probably more like $20 billion and $40 billion, and with a disproportionate part of the $20 billion in the near-term being spent on cruise ships and the international parks. It’s also fair to say that’s the most optimistic projection, and a lot could change, potentially impacting and reducing that number. This is not a new development–we’ve written all of this before. Only this time, Disney’s own CFO is saying something similar.

Both during the earnings call and an interview prior to it on CNBC, Bob Iger once again reiterated his bullishness on theme parks and desire to “turbocharge” its growth. He indicated that Parks & Resorts remains a “growth story” and a well-managed one, at that.

Iger added, “even in the case of Walt Disney World, where we have a tough comparison to the prior year, when you look at this year’s numbers compared to pre-pandemic levels in fiscal ’19, we have seen growth in revenue and operating income of over 25 and 30%, respectively.”

He noted that “Over the last five years, return on invested capital has nearly doubled in our domestic parks, and we have seen sizeable increases over that same timeframe across the total Experiences portfolio as well. Not to mention, the improved guest experience ratings we’re now seeing at every one of our parks.”

“As we announced in September, we plan to turbocharge growth in our Experiences business through strategic investments over the next decade,” Iger added. “Given our wealth of IP, innovative technology, buildable land, unmatched creativity, and strong returns on invested capital, we’re confident about the potential from our new investments.”

On CNBC, Iger was asked whether this changes if there isn’t a ‘soft landing’ and the U.S. economy tips into a recession. Essentially, Iger said that near-term has no bearing on Disney’s plans to expand the parks. “If you look at the track record, particularly in the last 5 years, but you could look back another 10…the investments we’ve made domestically and even globally have really paid off.”

Iger pointed back to the Great Recession and said that economic blips come and go, and that the company does not invest for any particular moment in time–they invest for the long-term. “When we looked ahead at how to allocate capital…we decided a great place to place our bets or capital would be the parks.” He added that past investments in the parks have all quickly paid for themselves, and that the returns have been strong. The “trajectory is very bright for parks,” Iger said.

This is all great and reassuring to hear. We’ve had apprehensions about how quickly Disney would be in a financial position to actually make these investments and the answer appears to be sooner than we expected. It’s also great that Disney is thinking long-term about all of its investments; it doesn’t seem like that’s always been the case.

Iger expressing bullishness even in the event of a recession is also good to hear. This also makes complete sense if Disney wants to be aggressive, as interest rates and the cost of debt-servicing presumably drop in the event of a recession, making investments ‘easier’ even if the short-term is bleaker. Of course, plans could also change. It’s easy for Iger to say they’ll do one thing in the event of a recession–follow through is what matters.

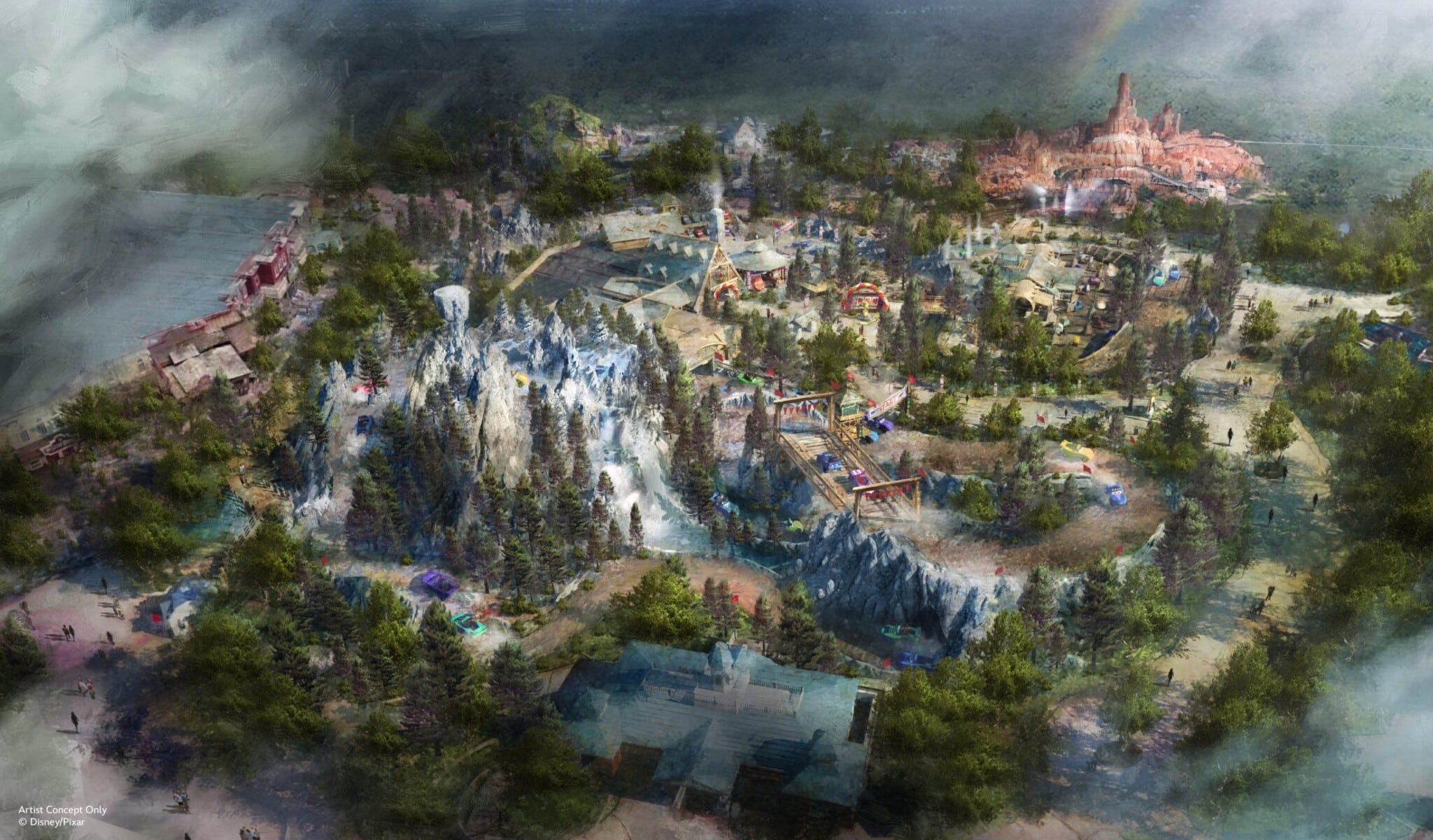

Ultimately, long-term investments in Walt Disney World and Disneyland are what it’s all about for us. This is why we’re so keen on streaming reaching profitability, Disney paying down its debt, ESPN getting into gambling and other strategic partnerships, the company divesting itself of linear networks, etc. It all potentially paves the way for $17 billion investment plans at Walt Disney World and expansion as part of DisneylandForward in California.

As we’ve said so many times, we’re standing on the precipice of another “Disney Decade” for the theme parks…as soon as the company is in a position to devote the CapEx necessary to it. Even spread across the international parks, $60 billion is a lot of money (and presumably not much of that would be going to Disney Cruise Line since it’s wrapping up a colossal fleet expansion) that could result in massive expansion at Magic Kingdom, Animal Kingdom, and who knows what else in EPCOT, Disney’s Hollywood Studios, and Disneyland Resort!

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What do you think of Walt Disney Company’s full year and fourth quarter 2023 earnings and future forecast? Surprised that Disney+ gained 7 million subscribers? What about per guest spending at Walt Disney World and Disneyland, or other theme park results? Excited for the “turbocharged” investment of $60 billion in Parks & Resorts? Thoughts on a slowdown at Walt Disney World or Disneyland? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!