In a new SEC filing, Disney has made its counterargument against Trian’s “Restore the Magic” campaign that’s aimed at securing Nelson Peltz a seat on Disney’s Board of Directors. This comes after a media and marketing blitz by Peltz, who is trying to make his case to fans and investors that he can fix Disney’s faults.

We’ve already covered Peltz’s initial slide presentation to “Restore the Magic,” which sounds to us like a “Save Disney” remake–minus having Roy E. Disney as the face of the campaign. We’ll revisit some of that commentary here in light of Disney’s new SEC filing and interviews, and further explain why we think this proxy fight could be good for Walt Disney World and Disneyland fans.

Even if you haven’t read our part one of the “Restore the Magic” saga, there’s a good chance you’re already familiar with this battle. If you’re active in Disney circles on social media, there’s a good chance that you’re being bombarded with “Restore the Magic” ads or sponsored posts. Peltz has also already done several interviews, with Disney responding both directly and indirectly. Suffice to say, it’s go to be a long and public fight.

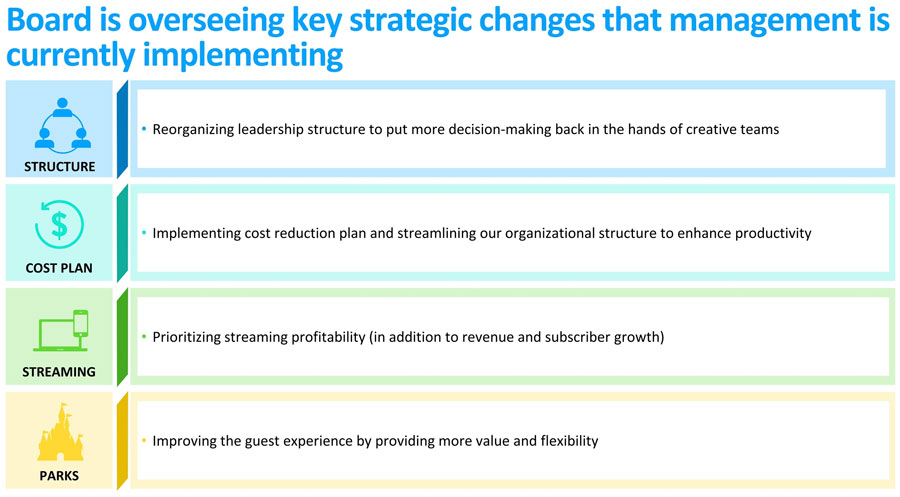

Let’s dig right into Disney’s new SEC filing, which is essentially a Powerpoint presentation. In this, the company leads with the argument that the Disney Board of Directors is independent, “highly qualified” and has “provided strong oversight focused on delivering superior, sustained shareholder value.” Disney also touts how the board “regularly reviews, and is heavily involved in, setting the strategic direction of the company.”

This includes the launch of the direct-to-consumer platform (DTC) and pivoting from growth to focusing on profitability. It also purportedly includes addressing “leadership challenge” as they emerge, with a “focus on succession.” Disney also points to incoming Board Chairman Mark Parker, and how he’s an exemplary leader for Disney, as well as Carolyn Everson, who was added to the Board and has media expertise thanks to her roles at Meta and Microsoft.

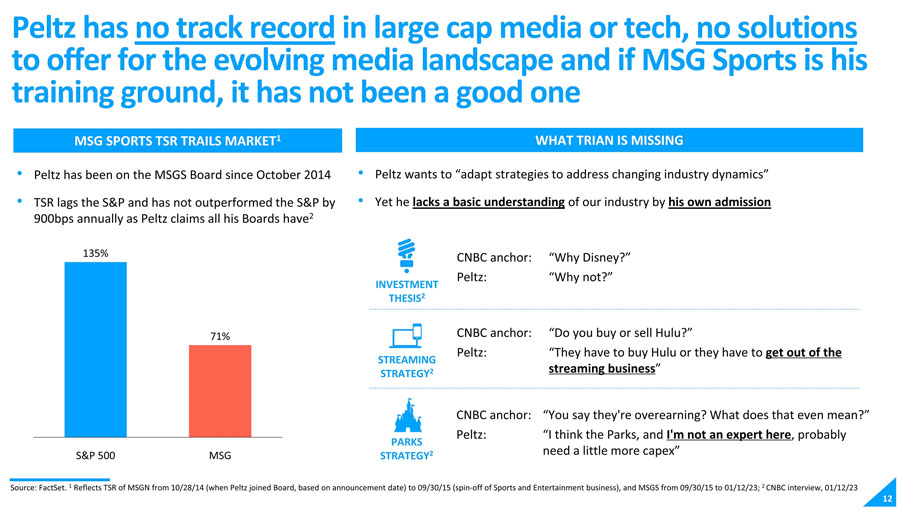

Following this, Disney dedicates an entire slide to the following assertion: “Nelson Peltz does not understand Disney’s businesses and lacks the skills and experience to assist the board in delivering shareholder value in a rapidly shifting media ecosystem.”

If Disney were leading with its strongest argument, it would be a loser. DTC is precisely the problem, and if Disney’s assertion is that the Board has done a good job with that–hemorrhaging billions per quarter–that’s quite the suspect claim. Same goes for dealing with leadership challenges and succession planning. I doubt anyone is going to give Disney’s Board high marks for the decision to extend Chapek’s contract only to fire him a few months later, leading to severance payments of over $20 million.

As for succession planning (or rather, lack thereof), Disney’s track record is well-documented. While I’ll agree with the company that Mark Parker is a good choice and establishing the Succession Planning Committee is a smart move, that happened as Disney geared up for this proxy fight. Peltz’s easy retort is: “See? I’m already instigating positive changes.”

Drawing attention to Peltz’s lack of track record in media is accurate, but that’s not a contrast with Disney’s current board. Carolyn Everson is highlighted because she has the closest thing to media experience, and that’s via Meta (Facebook) and Microsoft. Not exactly apples to apples with Disney.

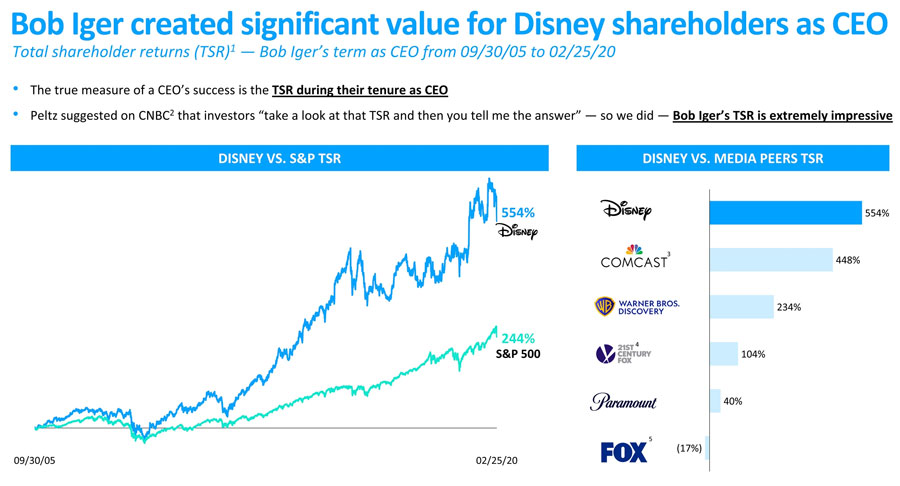

Fortunately for the company, Disney did not lead with its best case against Peltz. Following an ironclad argument about Bob Iger’s tenure and his track record of growth, the company digs deeper into its mergers and acquisitions.

Disney highlights the purchases of Pixar, Marvel, and Lucasfilm, saying they enhanced the company’s value for shareholders and were transformative for the company. Again, these successes are indisputable. Iger grew Disney’s portfolio into an intellectual property behemoth beyond just animation.

Pixar has continued to perform well, with the Star Wars franchise and Marvel Cinematic Universe delivering outsized box office performances and being the foundational assets for the Disney+ streaming service. Even if you don’t like Star Wars or Marvel, there’s little denying that those purchases look like bargains in retrospect. The financial results speak for themselves.

Disney goes on to defend its acquisition of 20th Century Fox. The company argues that this transaction was “critical to better positioning Disney to address key secular shifts in the media sector” and goes on to make the case as to why. Disney points to how the Fox purchase broadened its brand (FX, Hulu, NatGeo, Star, etc.) and intellectual property portfolio (Avatar, X-Men, Simpsons, Deadpool, etc.) and provided the company with a “deep bench” of talent, including Dana Walden, who’s a future CEO candidate.

Disney goes on to correct factual errors in Peltz’s argument against the Fox purchase, openly questions whether he’d prefer a competitor have purchased Fox, and goes on to explain why the company did not overpay for 20th Century Fox. All of this is compelling, even if the purchase price of Fox does appear high upon superficial inspection.

As I’ve said before, this is my main hesitation with critiquing the 20th Century Fox transaction. Sure, it sounded like way too much to pay, even at the time and especially as compared to Disney’s previous trio of acquisitions. However, I have the self-awareness to recognize there’s a lot I don’t know.

Betting against Bob Iger when it comes to M&A is like betting against James Cameron when it comes to blockbusters. They know more than you, whoever you are, so just don’t do it. Consequently, I’ll set aside my novice, surface-level impression of that deal and defer to Disney and Iger. They’ve earned it.

In the most humorous slide of Disney’s presentation, it uses Peltz’s own words against him, via a CNBC interview last week that…did not go so well! Without question, if that interview were your only exposure to this proxy fight, you’d think Peltz was out of his element and possibly only doing this to be a chaos agent.

Peltz didn’t have many good, substantive answers for what he’d bring to the table and some of his claims were factually inaccurate. Other interviews and arguments have been far more persuasive, so we view this slide more as an amusing eye-poke than a compelling case made by Disney.

Disney then goes on to rebut some of Peltz and Trian’s claims about motivations. These do not strike me as worthy of highlighting. It’s spin in both directions–Peltz wants to cast himself as the savior and Disney wants to frame his as the villain, eager to oust Iger. Neither reflect reality, which is more nuanced and messy.

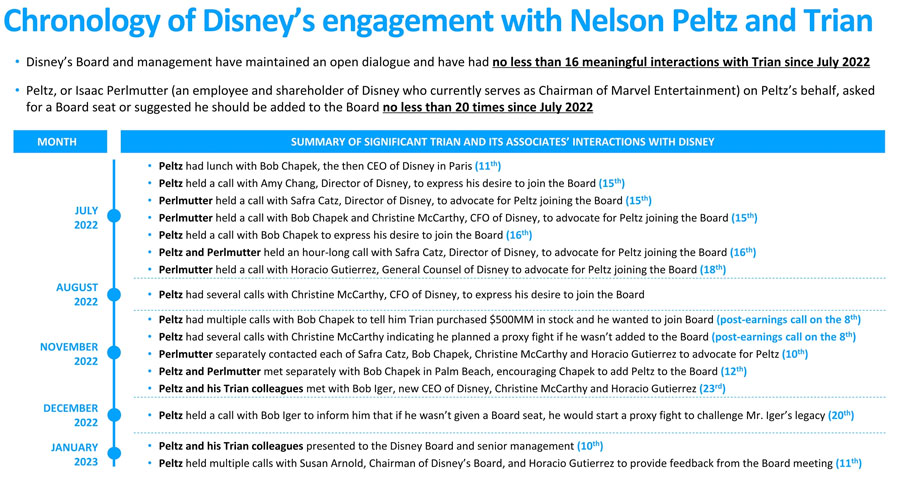

Disney’s SEC presentation concludes with a timeline of the company’s engagement with Peltz. The first thing that should stick out is how many times that Chapek and Peltz met (and also that Ike Perlmutter was an apparent catalyst for this, because of course he was). Now contrast that with how new CEO Bob Iger has essentially given Peltz the cold shoulder.

Disney’s SEC Proxy Statement provides ‘color commentary’ here: “Mr. Perlmutter said he and Mr. Peltz supported Mr. Chapek, and that adding Mr. Peltz to the Board would help Mr. Chapek counter recent headwinds he had faced, solidify his position as CEO, and preempt any other potential shareholder nominations of director nominees at the 2023 Annual Meeting. He said without Mr. Peltz there, former executives including Mr. Iger, would be back at Disney.”

That paints a clearer picture of why things played out how they did. Chapek was more receptive to Peltz because the beleaguered CEO needed allies. Previously, we speculated that Disney’s Board of Directors might’ve brought back Iger to gear up for this fight, feeling that Chapek was not up to the task. With this added info, it’s possible that it wasn’t a matter of Chapek not being suited for battle–maybe Chapek didn’t want to fight because he wanted an ally on the Board.

In terms of commentary, I actually want to start by revisiting and supplementing my analysis of “Restore the Magic” from the last post. To be clear, I do not think Nelson Peltz has altruistic motives. It’s doubtful that any reasonable person actually thinks that Trian is interested in “Restoring the Magic” in the same sense that fans want it restored. That’s simply the marketing slogan–and just like most marketing, it’s BS.

Peltz almost certainly does not care about the intangibles or the company’s creative legacy, history, etc. This is precisely why I drew a contrast between Peltz and Roy E. Disney, who had a vested stake and genuine passion for the company’s creative legacy. The interviews with Peltz make clear that he doesn’t really care or grasp any of that. Quite simply, he wants to see the company become more profitable, shift focus to parks (probably for the consistent cash flow), cut spending on streaming, and reinstate the dividend by 2025.

Obviously, Peltz being a corporate raider brings with it healthy skepticism about his motives. Some might have the perspective that such individuals are never good for brands and their fans.

To be sure, there is an inherent tension between investors and enthusiasts. It does seem like, more often than not, Wall Street gains come at the expense of fans. Cost-cutting and price increases are used to juice share prices, to the detriment of consumers. We have written about this type of short-term mentality countless times, and how it’s detrimental to Disney’s long-term health.

However, that is not what’s happening here. Peltz’s purported goals have time horizons no earlier than 2025. As its presentation points out, Trian Group is oriented on the long-term, and its track record and average investment commitment bears that out. This claim is not simply window-dressing to win over fans.

My view is that there does not necessarily have to be a tension between investors and fans when both are focused on the long-term health and responsible growth of the company. The notion that Wall Street is “bad” for brands is misguided. Fairytales about passionate creative visionaries single-handedly forging empires might suggest otherwise, but business acumen and fiscal restraint are also important. Industry and creativity can work hand-in-hand towards mutually beneficial ends–the key is both being focused on the long-run and not cutting corners.

The company prioritizing short-term revenue at Walt Disney World and Disneyland is precisely the critique we and other fans have been making over the last several years. Again, Trian’s core thesis is that price increases and nickel & diming is short-term thinking that puts the brand value and long-term health of Disney’s theme parks business at risk. This is a point we’ve made many many many many many many times.

Some Disney fans have contended that Peltz’s older age means he’s necessarily interested in milking Disney for short-term gains. I disagree. Warren Buffett and Charlie Munger are famously long-term value investors, even to this day, despite their combined age of 191 years old.

You could just as easily argue that since Peltz is older and has already accumulated wealth beyond what he can spend in his remaining years, he’s interested in legacy-building. Maybe Peltz is targeting a prolific company like Disney because it’s a way of cementing his reputation long after he’s gone. This is not my contention, it’s just a plausible counterpoint. I won’t pretend to know what motivates wealthy investors to do what they do, but in my view, age is irrelevant.

It’s fair to not take Peltz’s claims at face value or question whether he has ulterior motives. However, it’s also fair to point out that it’s not clear and obvious that Peltz is bad (or good) for the company. There has been vigorous debate by analysts and investors via Bloomberg, CNBC, Fortune, Barron’s, Financial Times, and others as to whether he’d be an asset to Disney. (Those are all links to specific articles that you can read for a well-rounded overview of this fight.)

The only thing that is clear is that there is no clear consensus about Peltz. Not among analysts, investors, talking heads–or even board members and leadership at companies that were previously in Peltz’s crosshairs. Some in the latter camp vouch for him, including those at Heinz and P&G who praise him for turning around those companies. In other cases, he’s not viewed in much less fond terms. His track record–which is unquestionably mixed–is called into question.

According to FT, “Peltz is widely considered to be a fairly constructive activist investor, according to people who have found themselves on the other side of the negotiating table.” A source close to Disney put it in blunt terms: “As usual with [Peltz], you know, there’s always some kernel of truth, and there’s always some level of bullshit.”

In my view, it’s the kernel of truth that is significant, and what that could do for Disney. The bluster doesn’t really matter one way or another.

Already, Peltz has prompted changes at Disney. That is, unless you believe that the abrupt announcements of 3 BIG Changes at Walt Disney World to Improve Guest Experience & Value and Good Changes Coming to Disneyland had nothing to do with him, and it was total coincidence that that news dropped hours before Peltz launched his proxy fight.

To be sure, this is not entirely due to Peltz. D’Amaro and other leaders at Walt Disney World have been eager to improve guest satisfaction, but had their hands tied. Iger was acutely aware of this, expressed “alarm” at Walt Disney World price increases, and was concerned that Chapek was “killing the soul” of Disney. All of that is well-documented, and predates the Peltz proxy fight.

However, it’s impossible to dismiss the standoff with Trian and Peltz as playing zero role, especially given the timing of the aforementioned changes at the parks, Mark Parker’s elevation to Chairman, and establishment of the Succession Planning Committee. At minimum, “Restore the Magic” has been an accelerant that has already fast-tracked plans that were previously in motion.

Hence the statement in the prior post that corporate politics makes strange bedfellows. To whatever extent an alliance exists here between Peltz and fans, it’s one of convenience. It’s not because our values align, but because he might be means to an end. If he causes the company to focus less on streaming and more on the parks, and making Disney more accountable–that’s a win for fans.

Beyond what has already happened, the battle will almost assuredly prompt additional positive changes at Disney. In an attempt to undercut Peltz’s position, the company will likely voluntarily making some of the requested changes and improvements to demonstrate that he can’t add value since they’ve already implemented all of his suggestions.

Among other things, this means reining in runaway spending on streaming content, clear succession planning, and deleveraging. For Walt Disney World and Disneyland, it also likely means more manageable price growth, less nickel & diming, and improved guest satisfaction. It also just might mean park expansion projects are given the green light, as a good faith showing that there’s long-term vision of the parks and they don’t exist to simply subsidize streaming losses. (Josh D’Amaro and Bob Iger just spent the week touring Walt Disney World…there was likely a reason for that.)

With that said, this is only good news if you’re primarily a fan of Walt Disney World and Disneyland, and not instead focused on the Disney+ streaming service. The flow of high-budget content will likely slow over time and its price will increase, as Disney+ is simply not sustainable at present. From my perspective, this is great news–I don’t really care about Disney+ and am tired of the theme parks subsidizing other folly and failures. Others may disagree, and that’s fine.

At the end of the day, it’s only one board seat (at most). There’s only so much Peltz can do with that, and dismantling Disney and selling it off for parts (or whatever other fears fans have) most assuredly is not one of those things. For me, it’s the battle that has the value. This has already been very high-profile and the topic of exhaustive media coverage–that will continue to be the case as the battle heats up. So long as Disney is fending off this fight, they will keep making positive changes in the parks to demonstrate Iger is serious about “improving the guest experience by providing more value and flexibility.”

Need Disney trip planning tips and comprehensive advice? Make sure to read 2023 Disney Parks Vacation Planning Guides, where you can find comprehensive guides to Walt Disney World, Disneyland, and beyond! For Disney updates, discount information, free downloads of our eBooks and wallpapers, and much more, sign up for our FREE email newsletter!

YOUR THOUGHTS

What do you think about Disney’s response to the “Restore the Magic” Campaign? Did the company make a compelling case, or are its arguments flawed? Skeptical about that Nelson Peltz’s real motivations, or think he’s truly interested in long-term success? Think this will be beneficial for the company and fans at the end of the day? Optimistic that this will push Iger to finally get serious about choosing a successor or focus on improving guest satisfaction in the parks? Thoughts on anything else discussed here? Do you agree or disagree with our assessment? Note that neither Disney nor Peltz brought up politics or culture wars in their presentations; as such, all off-topic comments about either will be deleted.