This article originally appeared on DeFi Mafia’s Substack Newsletter >

Clever Ponzi or Much More?

My write up today was inspired by this CoinDesk article that has been making the rounds on crypto twitter recently. It’s well written and decently researched, but it’s clear the author does not fully understand what Olympus is, or plans to be. He’s not alone either, most people in crypto still don’t understand Olympus, including most (3,3)ers.

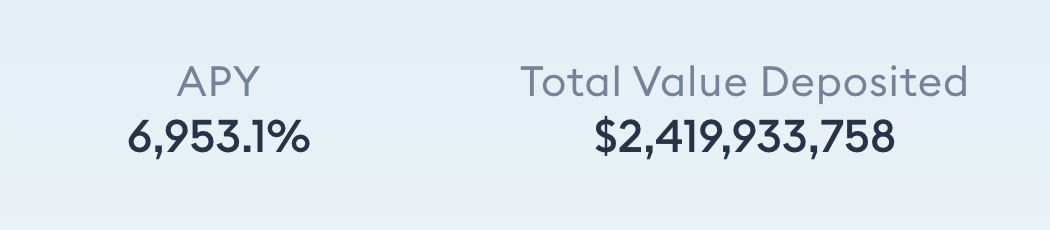

When one opens the Olympus staking dashboard their eyes are immediately drawn to what must be an unsustainable yield generated by some form of ponzi-nomics. Right?

As of writing the current APY reward for staking $OHM is just shy of 7,000%. This obviously can’t be possible. After all my ‘high-yield’ savings account gives me 0.5%, Olympus is providing nearly 14,000x that.

On top of the APY, Olympus has the stated end goal of $OHM as being the “decentralized reserve currency of crypto,” the ultimate store of value. To many, reading this immediately sets off alarm bells in their head.

It’s understandable for one’s first reaction to be “this is some form of a new scam”, and that seems to be the case for nearly all who come across it. Truthfully, I had the same reaction when I first discovered Olympus in May of this year.

So, how about this: you start with the default assumption that Olympus is in fact a Ponzi scheme due to collapse any day now, but read through this piece anyways and give me the chance to see if I can convince you otherwise.

What is Olympus Trying to Solve?

Before we can assess whether or not Olympus is a Ponzi, we must first understand the problem they are trying to solve, and how they plan on doing so.

Over the past two years DeFi has been a marvel of financial innovation. The invention of Automated Market Makers (AMMs) enabled Decentralized Exchanges (DEXs) to be possible, decentralized Money Markets allow users to lend and borrow from pools without any middlemen or paper work needed, and so on.

But there is a common challenge across all of DeFi that has plagued almost every project thus far, the ability to attract and maintain high levels of liquidity. Without liquidity all projects die, so it’s one of most important focuses of any DeFi founding team.

“Liquidity is the bandwidth of DeFi.” – Carson Cook, Co-Founder @Tokemak

Prior to the Olympus model, projects would often initiate liquidity by raising money from VCs and issuing what are commonly referred to as ‘farm tokens’. These are tokens that are paid out to users as an incentive for providing liquidity.

This model is great at solving part one of the liquidity problem, attracting liquidity in the first place. Typically projects issue tokens on a pre-specified emission schedule that is very attractive to liquidity providers who get in early as the supply of the token is initially low, and demand is high. The demand is high initially because in order to be an LP one needs to exchange half of the money they intend on adding to the liquidity pool for the project’s token.

Example: I want to provide $10,000 of liquidity to the SUSHI-ETH pair, I would first have to swap $5,000 of my ETH for SUSHI and then add equal amounts SUSHI and ETH to the pool. This creates an initial demand side catalyst when a new farm token launches.

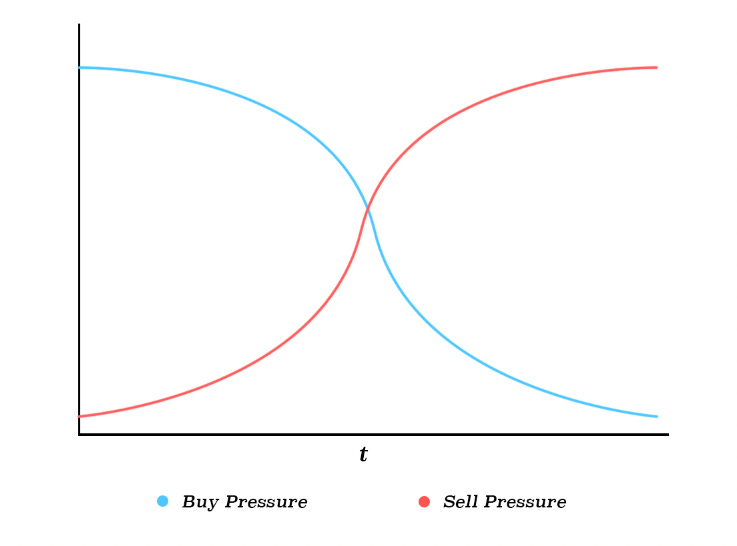

However once the pools get filled as LP pile capital in, yields quickly drop as the LP fees are distributed between an increasing amount of LPs. Essentially, splitting the ‘LP fee pie’ into thinner and thinner slices as more entrants arrive. This lowers the attractiveness of entering these pools over time, reducing the initial demand generated by LPs needing to buy the farm token.

In addition to the demand for the farm token reducing over time, the sell side pressure increases drastically as well. Seasoned LPs know very well that owning farm tokens is like holding a ticking time bomb, toss them away quickly or watch your gains blow up. An LPs goal is simple, provide capital in exchange for promise of more capital back. However in most cases the capital given back to them is in the form of these farm tokens, so they will quickly sell these farm tokens off in exchange for safer forms of capital such as stablecoins.

The initial demand decreasing in combination with sell pressure increasing over time creates a vicious feedback loop often leading to a complete crashing in price of the farm token, causing liquidity to exit out of the pools just as quickly as it came.

The Olympus Solution: Protocol Owned Liquidity

So now that we’ve established farm tokens are good at solving part one of the liquidity problem, attracting it in the first place, how do solve the problem of keeping it?

The core of the problem is that protocols are in essence ‘renting’ their liquidity by paying out unsustainable incentives.

Normally when one wants to own an asset they would go to an exchange and swap for it. Back to our SUSHI-ETH example from above, if I have ETH and I want to own SUSHI I would need to swap one asset for the other. In doing so I would be using up some of the liquidity of the pool. But what if there was another option? A way in which one could acquire an asset while not only maintaining the pool’s liquidity, but actually increasing it. Is that even possible?

With Olympus’ new model, yes.

Introducing Bonds.

The brilliant innovation that Olympus has brought to the table is the ability for protocols to own their liquidity without having to raise massive amounts of VC capital.

They do this by issuing bonds that allow investors to purchase $OHM at a discount in exchange for giving Olympus the ownership of LP tokens, creating a new way of acquiring an asset without directly swapping for it.

Example: I want to purchase $10,000 of $OHM, and the current market price is $500. I could swap for them, or I could buy $5,000 of $OHM and $5,000 of DAI and add to the liquidity pool and receive OHM-DAI LP tokens instead. I can then use these LP tokens to purchase bonds, which allow me mint new $OHM at discount from the market price. If the bond discount is sitting at 10%, then I would be able to buy $OHM for $450, even though the market price is $500.

Olympus is willing to make this tradeoff because as I hope is clear by now, liquidity can mean life or death for a protocol. Of course the question is, will this actually work? When Olympus initially launched they weren’t sure, it was a grand economic experiment, and this was the result:

For all intents and purposes Olympus owns all of their protocol’s liquidity, an achievement that cannot be understated. They invented and proved that this new model for bootstrapping liquidity not only works to attract it, but maintain it over time. Solving both sides of the puzzle that challenged so many before them.

Now this is great and all, but what’s stopping investors from dumping their newly minted tokens and locking in the the 10% arbitrage as mentioned above? Sure Olympus owns the liquidity, but the price of the tokens themselves would decrease over time with all of the sell pressure from bond minters looking to cash out.

This is where staking comes in.

Staking & That Crazy APY

Finally we can get to part that scares off so many, and creates the impulsive Ponzi scheme accusations, the APY earned from staking $OHM.

$OHM like the original farm tokens emits more tokens over time. The token emissions are issued to the bond purchasers as mentioned above, and to the token stakers. This staking incentive is used to prevent bond purchasers from selling of their tokens immediately after their lockup period ends.

When one stakes their $OHM, they are not exactly earning more money over time, what they are really doing is locking in their ownership share of the protocol (minus the bond dilution).

Example: Let’s say the total number of $OHM in existence is 100, and I buy and stake 1 $OHM; I would own 1% of the total supply. Fastforward one year, and now because of the emissions, the total supply is say 1,000 $OHM. If I had held and staked my tokens the entire time I would now have 10 $OHM, 10x the amount I originally had. Great! Right? Not so fast.

The number of $OHM I own has changed, but my share of the protocol hasn’t, I still own 1%. So if the market cap was $1 million when I staked, and is still $1 million a year later, I haven’t actually made any money, I just own smaller slices of the same pie. I only make money when the market cap of the protocol grows.

Of course this is an oversimplified example, but goal is to get the point across is that what matters is not the total number of tokens you own, what matters is the future growth of the protocol. This is no different than the traditional model of investing in a startup, you need it to grow to make money.

So how does Olympus grow?

In the beginning like any other startup, from speculators; Early believers who are betting on the future growth of a project. These early believers are mostly bonding or buying, and then staking, growing the Olympus treasury and overall market cap. But like any business, raising money is not an end, it’s a means to one.

Olympus is now at the stage, with a treasury quickly approaching $1 Billion, that they have the resources to become a DeFi powerhouse; a firehose of liquidity and capital that can be strategically pointed in directions that will in return further grow the treasury.

All that any $OHM staker ultimately cares about is non-dilutive treasury growth. Growing the treasury via bonds is great in the beginning, but it’s no different than a business who only grows their balance sheet by issuing new shares thus diluting current shareholders.

Revenue generation is the only sustainable long term method of treasury growth. So how is Olympus generating revenue? Through highly in demand DeFi services needed by other protocols.

Olympus Services

To keep this already long enough write up from getting too long, I’m not going to go into extreme depth on each individual service that Olympus is or will potentially offer. But I’ll give a quick description of a few.

- Olympus Pro: Liquidity as a Service for other DeFi protocols who wish to take advantage of the owned liquidity model. They can issue bonds on Olympus’ bond marketplace and offer discounts on their tokens in exchange for ownership of LP tokens. Olympus receives 3.3% of the protocol’s tokens as a fee.

- Olympus Incubator: Decentralized Venture Capital. New protocols that are looking to build on top of or adjacent to the Olympus ecosystem give an initial token allocation to Olympus in exchange for partnership, and also commit to keep a portion of their treasury in $OHM as well. This enables Olympus to own a piece of many of DeFi protocols of the future.

- OHM Swap (Potentially coming): A DEX built on top of Olympus utilizing the tokens acquired through the Pro and Incubator services to create LPs where Olympus collects the entirety of LP fees instead of using third party DEXs like Sushi Swap.

At this point I hope I have at the very least convinced you that even if Olympus’ end goal of being a decentralized reserve currency sounds Ponzi-like, that the problems they are actively solving and revenues being generated are nothing but legitimate.

Of course a protocol could provide all of these services and not try to be money. But why not? If one is creating an asset that has a real treasury backing it, decentralized ownership that comes with governing powers, and a clearly laid out monetary policy, then why not take the final step of becoming money.

What really is money anyways, but a story we tell ourselves?

Olympus is a Great Story

Money is a story. What’s the story of the US Dollar? It’s the currency issued by government of the largest economy in the world who also controls the world’s largest military and oil supplies.

But eventually all good stories must come to an end, only to be replaced by even better ones. Is $OHM a better story than $USD? That’s certainly up for debate, and there are merits to both sides of the argument.

At the moment, $OHM is no where near ready to become a reserve currency. But in ten years? Who knows.

In the meantime Olympus will continue to execute at the highest level of nearly any protocol in DeFi. They will continue to take advantage of the flywheel of capital that they’ve created, and perhaps one day we can revisit this conversation again.

Until then I’ll be staking and contributing to the DAO in ways that I can, and maybe after reading all of this you will too.

Ready to start your consulting business? Our MGR Team will be happy to chat with you one-on-one. Use this link to contact us and set up your free consultation.

Thank you for reading. Until next time, this is Manuel Gil del Real (MGR)

Note: this article is for entertainment purposes only. It is not intended to be financial advice. The opinions and views expressed above (written, video or audio format) are solely of their respective authors and do not express the views or opinions of MGR Consulting Group, its employees, clients or affiliates. Individual results will always vary depending on your individual investment experience, work ethic, business skills, perseverance and diligence in applying your own business plan, the economy, the normal and unforeseen risks of doing business, and other factors. All trademarks are property of their respective owners.