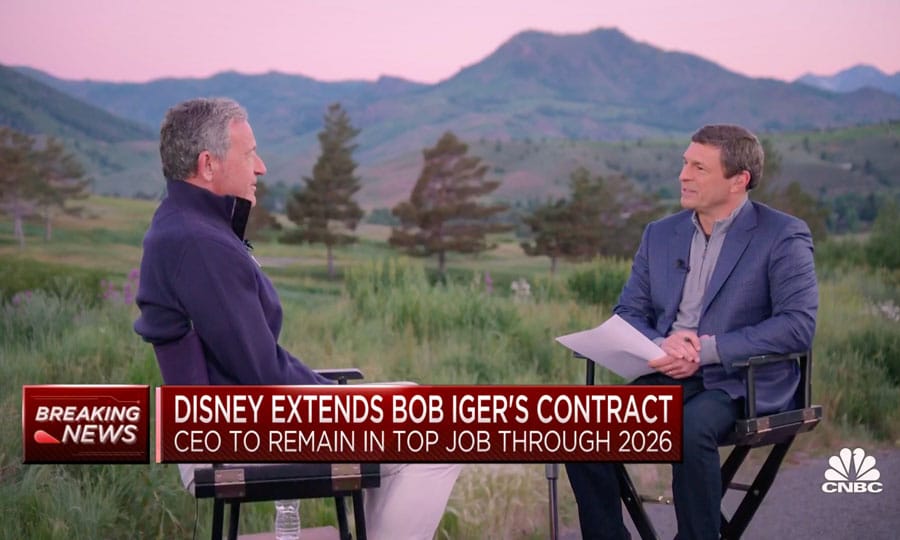

Following his 2-year contract extension, Disney CEO Bob Iger spoke with CNBC’s David Faber about the future of Walt Disney World and Disneyland, streaming services, legacy media, as well as potential sales or acquisitions. This post will recap some of the highlights will interjecting our ‘between the lines’ commentary.

The backdrop of Iger’s interview was the chilly mountainside in Idaho, where Iger is making a return for the investment bank Allen & Co.’s annual conference in Sun Valley. The summit is a veritable who’s who from Hollywood, Silicon Valley and Wall Street, sometimes referred to derisively (or lovingly, I guess, depending upon the audience) as “billionaire’s summer camp.” It’s frequently a hotbed for mergers and acquisitions, with handshake deals struck among media and tech titans.

In fact, former CEO Michael Eisner famously made the deal for Disney to acquire Capital Cities/ABC for $19 billion back in 1995 at Sun Valley Resort. That’s often viewed as the first megadeal made at the conference, cementing its reputation as the place for media moguls to talk M&A. This is all relevant because it’s widely expected that CEO Bob Iger will spin off declining businesses to pay down debt and create a leaner, more focused Disney. M&A experience also likely plays a major role in Iger sticking around through 2026.

That’s as good of a jumping off point as any, and Faber was quick to ask about Iger extending his contract even after telling the interviewer back in February that he would not. Iger said that Disney has “gotten a lot done very quickly” and pointed to significant cost reductions, significant restructuring, major personnel changes, and dealing head-on with the biggest challenges and looking for opportunities.

Iger indicated that he is “quite pleased” how much Disney has accomplished in a short period of time, but noted that there are a lot of challenges, that the market has to cooperate, and post-COVID recovery remains ongoing. He went on to say that he’s “extremely optimistic” about the company and its assets, but that the challenges are greater than he had anticipated, including some “self-inflicted” damage.

When pressed about what he meant, Iger said that the disruption of the traditional television business is the most notable. This was something Disney saw coming years ago, but the decline has been sharper and faster than anticipated. To that point, Iger stated that there’s necessary “transformative work” to be done to ensure cost structure reflects the economic realities of the business that includes disruption.

He also said that Disney needed to assess “no growth businesses” like linear and see what opportunities exist. When asked specifically, Iger went on to suggest that Disney could sell ABC, FX, NatGeo, and other cable networks because they “may not be core to Disney.” He said it wasn’t a matter of creativity, but the business and distribution model for linear is “definitely broken.”

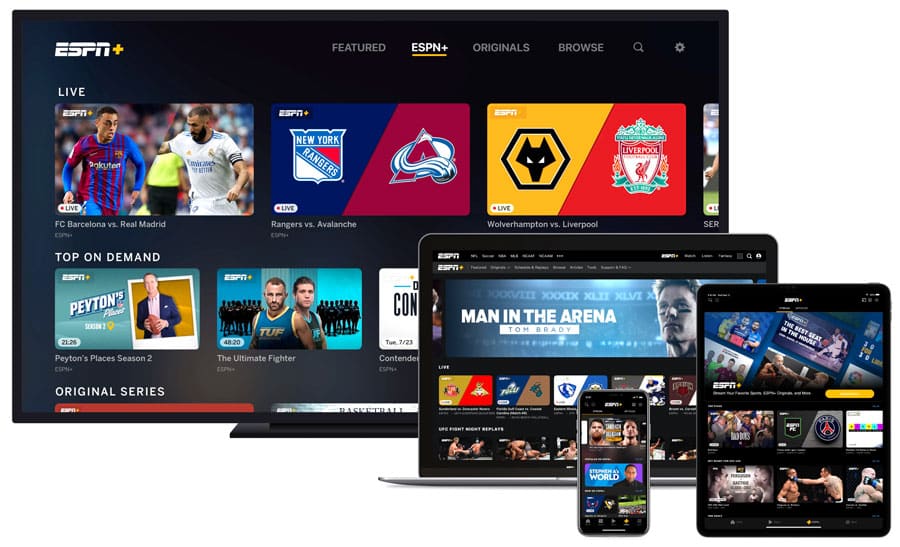

Iger also distinguished ESPN from the other cable networks, and said Disney was thinking differently about it. He said Disney’s position in that ESPN is very unique and a great brand. “We’ve had a great business, and we want to stay in that business. That said we’re going to be open minded there too. Not necessarily about spinning ESPN off, but about looking for strategic partners that could either help us with distribution or content, but we want to stay in the sports business,” Iger explained.

Based on both his comments during the interview and the way Disney has restructured to silo off ESPN from the other divisions, it’s pretty clear that Iger has something up his sleeve with ESPN. There has been a ton of speculation about Apple acquiring Disney, but I think that’s off-base. My bet is that there’s a Disney-Apple deal for ESPN on the horizon. Not necessarily a sale, but a big deal that makes ESPN, for all intents and purposes, part of Apple TV Plus.

Apple TV+ has already started to test the waters with live sports, and clearly has an appetite for more. They lost out on the bidding war for NFL Sunday Ticket to Google (YouTube), which was a big blow. Sports would be hugely beneficial to Apple and they have the money to burn on a major acquisition or strategic partnership.

One of Apple’s many problems–beyond just a lack of sports content–is brand recognition and coverage quality (Friday Night Baseball on Apple is awful). ESPN would instantly address that. Plus, I think Iger is more inclined to make a deal with Apple than anyone else–the marriage between Disney and Apple makes sense. I have zero insight beyond intuition and gut instinct, but I think an Apple-ESPN deal happens. (I do not think Apple–or anyone–will acquire Disney outright.)

Iger also addressed Hulu, and offered the strongest ‘confirmation’ to date that Disney’s plan is to acquire Comcast’s stake in the streaming service (there’s already a long-standing agreement for this transaction in 2024, but Iger previously said he’d reevaluate that). According to Iger, Disney is better off with Hulu than without it, and the tentative plan is for Hulu to be available starting the end of 2023 as part of the Disney+ streaming service.

Given that this is a theme parks blog, many of you may not really care about cable networks, streaming services, and so forth. However, Iger addressing those disruptions and reducing Disney’s debt load is absolutely a necessary prerequisite to future growth of Walt Disney World and Disneyland. To that point, let’s switch gears…

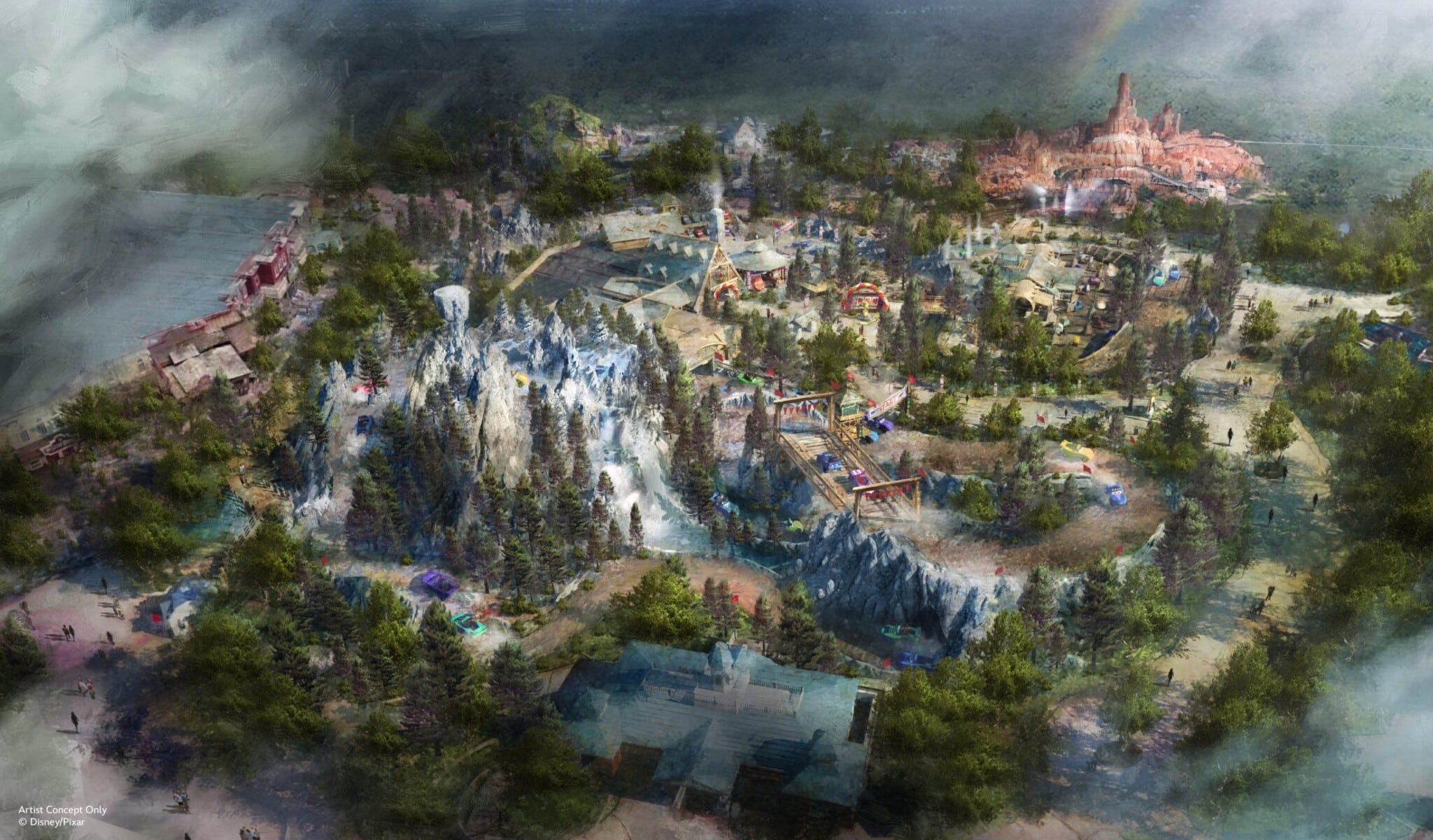

When asked earlier in the interview–during the portion about disruption and challenges–where Disney was doing well, Iger was empathic about the future of Walt Disney World and Disneyland. “There are other elements of the business that I have huge optimism about, for instance, Parks & Resorts which is just a tremendous business for us,” Iger said.

He continued: “We’re invested significantly and the investments we’ve made over the years are really paying off today. Shanghai Disneyland is a great example of that, [as is] the Star Wars Land…I’ve really believed in the future of that business. We actually have opportunities there to turbocharge that growth.”

With only a few minutes left on the clock, Faber returned to the topic of theme parks, bringing up reports that there have been slowdowns at Walt Disney World. Faber asked whether the DeSantis vs. Disney feud in Florida is now having an impact on attendance. “No, no, we see no sign of that at all,” Iger responded.

Iger then laid out all of the reasons why attendance around Independence Day was lower, saying that the temperature was about 100 degrees and 99% humidity on that day. He added that “Florida opened up early during COVID and created huge demand and didn’t have competition because there were a number of other places, states that were not open yet.”

Iger continued: “If you look at the numbers in Florida in 2023, or just recently versus 2022…the state of Florida has been down. We actually track hotel tax revenue across the state, which is a matter of public record, and there are counties in Florida that had been down 6, 7% recently. We also know that our competitors are discounting in that state. So there are some near-term issues in Florida that I don’t think had anything to do with politics.”

On some of these points, Iger is 100% correct. Hot weather likely was a contributing factor to late June and early July crowds. Florida seeing “revenge travel” earlier and thus it being exhausted sooner is absolutely a fair point, and one that has been brought up here previously. It’s also true that hotel occupancy tax collections are down in many major tourist hubs around Florida. Universal and other competitors are discounting.

And as we’ve said before, there is very little reason to believe politics is having any material impact on attendance or revenue. When you look at the data for Walt Disney World, Universal, and the state as a whole, there just isn’t much to support that narrative. A lot of readers contested that when it was our assessment, but perhaps you’ll believe it when coming from Iger? (Again, this is not to say it’s not causing people to change vacation plans on an individual level; but to whatever extent that’s happening, it more or less nets out to nothing material.)

However, this is also not the whole story. It wasn’t just the hot Independence Day weekend that was slower, it’s been all dates since Easter (year-over-year). Not only that, but hot and humid summers are not exactly a new-for-2023 phenomenon in Central Florida. Competitors are discounting more, but Walt Disney World is discounting more aggressively, too. Not only that, but Disney has brought back Annual Passes and ticket deals to boost bookings. Despite hotel occupancy tax collections being down, TSA data still shows strong numbers of inbound travelers to Florida.

Obviously, Iger is doing a wide-ranging interview and doesn’t have the time to get into granular detail on all of this–I’m just happy he hit the points he did! Had he dug into the details more, I suspect Iger would’ve said that the discounts have been necessary to maintain those strong inbound numbers–thus explaining lower occupancy tax collections–and that data also suggests more people are heading to outdoor and non-urban destinations like the beaches, state parks, etc.

As for the particularly slow Independence Day weekend, the sharper drop there could’ve been explained by a mix of particularly brutal weather and, more importantly, ticket blockouts from July 1 to 4 that were unnecessarily aggressive. (Crowd levels have already rebounded from the lows for those dates.)

Faber asked whether Iger was concerned about the attendance decline at Walt Disney World, and Iger indicated that he was not–that it was due to a tough comparison last year with pent-up demand, and that long-term, the business is healthy. Iger was then questioned about whether higher prices were one of the issues. He was pretty clear on that: “Pricing is not an issue. We addressed some of those issues.”

“I don’t know when the last time you visited Walt Disney World, but I’d say it’s where the Disney brand lives in his most sublime form. I believe that it’s an incredible experience. It’s a very, very popular business and product and it’s very successful and we’re not wringing our hands over it,” Iger continued.

Obviously, Iger is going to spin and minimize where possible. I think the situation is a bit worse than he lets on, but still ultimately a healthy and natural correction so long as Walt Disney World makes the necessary adjustments to address guest satisfaction and lure back disenchanted fans.

With that said, Iger’s assessment of pent-up demand is definitely correct and his points about pricing are at least somewhat correct. (Due to all of the discounting, prices have effectively already decreased as compared to last year. This alone suggests that pricing was/is an issue, at least to some extent. But even that could be a story about pent-up demand and free-spending consumers in 2021-2022, and people taking a “break” from theme parks after spending big on them the previous 2 years.)

The topic then turned back to DeSantis, with Faber offering some “bait” with quotes from DeSantis.

Iger stuck to the familiar script: “So far what we’ve said publicly is that we are concerned that he has decided to retaliate against the company for a position the company took on pending legislation in that state. And frankly, the company was within its right, even though I’m not sure it was handled very well, it was within its right to speak up on an issue constitutionally protected right of free speech, and to retaliate against the company in a way that would be harmful to the business was not something that we could sit back and tolerate.”

“And so, we have filed a lawsuit to protect our First Amendment rights there and to protect our business frankly. The other issues that you referenced, the last thing that I want for the company is for the company to be drawn into any culture wars. You know, we’ve operated for almost 100 years as a company making product that we actually are proud of in terms of its impact on the world. I joke every once in a while we’re there to manufacture fun.”

Iger was then asked about neo-Nazis demonstrating outside the Walt Disney World gateway last month. “That was horrifying quite frankly and it’s concerning to me that anyone would encourage a level of intolerance or even hate that…could be turned into some dangerous act of some sort.”

He went on to say that he didn’t want to engage beyond that, “except to say that it’s it’s not our goal to be involved in a culture war. Our goal is to continue to tell wonderful stories and have a positive, positive impact on the world. You know, we are a preeminent entertainer in the world. And we’re proud of our track record there. The notion that Disney is in any way sexualizing children quite frankly is preposterous and inaccurate.”

The substance of the interview more or less wrapped up there, with Iger’s concluding remarks conceding that Disney has “a lot of work to do” but that his team is confident that it’s doing “the right work at the right timetable.” He’s also confident that Disney’s board is doing well, and stated that the succession planning process “is not going to stop–it’s going to continue and it should.”

Iger ended with reassuring words: “There’s so many things that we have to do and so much that we know we will do and can do and we’re optimists like, you know, I talk about optimism is a major quality of a great leader. No one wants to follow a pessimist. We’re optimists about the future of this company. We’ve gotten at the work already. We know what we have to do. There’s light at the end of the tunnel in in the most challenged businesses, and there’s an unbelievably bright future for the businesses that are less challenged.”

Ultimately, it was a mostly good interview. Although not a ton of time was spent on Walt Disney World and Disneyland, that was to be expected. As we’ve pointed out repeatedly, the immediate pressing concerns are all on the other side of the company. Addressing those is a necessary prerequisite to significant investment and expansion in the parks. Stated differently, Disney needs to pay down debt–ideally by shedding some media baggage–before it can turn its attention to Walt Disney World and Disneyland. The two things are absolutely and undeniably intertwined.

So from that perspective, this interview hit all the right notes for me. Iger was sober and realistic about the struggles and challenges faced by linear and streaming, teasing sales of cable networks and also some sort of strategic partnership for ESPN. Iger also talked up the theme parks and his optimism for the future of Walt Disney World and Disneyland, suggesting (yet again) that he is sincere about betting big on their futures. That’s more or less everything that I wanted to hear.

One final note that’s beyond the scope of what we typically cover, Iger did have arguably one unforced error in discussing the writer’s strike when he said their union has unrealistic expectations. That is already the ‘big’ clip from this interview making the rounds on social media, with many juxtaposing Iger’s comments with his huge salary. This is like the 5th time this has happened with media executives, and while I can understand their desire to address and put pressure on the issue, the optics are awful.

Beyond that, I was frankly shocked that Iger spent 2 full minutes essentially repeating the same, substance-less sentiment. He could’ve instead broken down the financial performance of linear, streaming, and other segments to illustrate the rapid decline in entertainment profits (not to be confused with revenue) over the last decade.

I’m not going to weigh in on this contentious fight beyond that, and also to say that social media is not real life. The concerns of certain outsized online voices are not the same as those of average American consumers, and definitely not of investors. Regardless, Iger could’ve chosen his words more carefully, presented his case in a more compelling manner, or, ideally, said nothing at all.

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

OUR THOUGHTS

What’s your reaction to any of Iger’s statements about selling off networks, entering a strategic partnership on ESPN, acquiring Hulu outright? What about the explanations he offered for lower crowds at Walt Disney World? Still think that it does have to do with politics or prices? Thoughts on Disney extending CEO Bob Iger’s contract through 2026? Think he can turn things around by then? Do you believe Iger is sincere in his optimism about future expansion at Walt Disney World and Disneyland? Thoughts on anything else discussed here? Are you optimistic or pessimistic about the Walt Disney Company’s future? Think things will get better in 2024-2025? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!