For the second time this year, Disney is facing a proxy fight from activist investor Nelson Peltz’s Trian Fund pushing for seats on the company’s board. His group will soon be reviving its “Restore the Magic” campaign–a sequel to the Save Disney remake (got it?!). This post delves into the details and offers our commentary about what’s in store as Bob Iger squares off against Peltz…for round two.

According to reporting by CNBC and the Wall Street Journal, Peltz’s Trian Fund has increased its stake in the Walt Disney Company to about 30 million shares, valued at roughly $2.5 billion. This stake makes Trian one of the largest shareholders in Disney. Trian is expected to request multiple seats on Disney’s board, including one for Peltz himself.

If the Walt Disney Company once again rebuffs the request, Trian could nominate directors that would be voted on at Disney’s annual meeting of shareholders in Spring 2024. The window for shareholder nominations runs from December 5, 2023 through January 4, 2024 per Disney’s proxy materials.

The Save Disney remake sequel comes only days after the company’s stock reached a 52-week low. Since Peltz and Trian called off the original Save Disney remake this spring, Disney’s stock price has tumbled from around $113 per share to around $80, their lowest level in a decade.

This comes a little over two years since Disney reached its all time high of around $200, driven by frothiness about the Disney+ streaming service and its growth potential during the pandemic. Wall Street’s enthusiasm for all streaming services has soured since, but Netflix has rebounded and Disney–a company with more than just streaming–has continued to be battered.

That’s all we know about the Save Disney remake sequel at this time. What follows is essentially a recap of the remake, in case you missed it when this first all went down at the beginning of the year.

Let’s go back to the beginning, with a quick recap of the remake saga…pre-sequel. Nelson Peltz kicked off his campaign to “Restore the Magic,” which was essentially a “Save Disney” remake. (For those who weren’t fans back then or haven’t read DisneyWar, SaveDisney was a proxy battle that began in 2003 with Roy E. Disney–the nephew of Walt Disney, who literally had a face that resembled his uncle–arguing that Disney was not living up to its potential and core values. It was the catalyst for the eventual ouster of CEO Michael Eisner and rise of Bob Iger.)

In its “Restore the Magic” campaign pitch, Trian made a detailed case in contending that many of Disney’s struggles are self-inflicted. Many of the slides in that seemed like they were lifted directly from “Save Disney,” right down to the language used to sway fans. Trian and Peltz pointed to mismanaged succession planning, both in the way Iger vs. Chapek was handled and also how prior CEO candidates were pushed aside. They also argued that Disney’s streaming strategy lacked focus and resulted in runaway spending and underperformance relative to Netflix, despite best-in-class IP.

Most notably from our perspective as Walt Disney World and Disneyland fans, the group contends that Disney’s recent approach to Parks & Resorts was unsustainable, with the domestic parks “over-earning” in order to subsidize streaming losses. Trian’s core thesis was that price increases and nickel & diming are short-term thinking that puts the brand value and long-term health of Disney’s theme parks business at risk.

In response, Disney Fought Back at “Restore the Magic” Campaign. The company released a Powerpoint presentation (in the form of an SEC filing) to plead its case and push back against Peltz. In that, Disney argued that its Board of Directors is independent, highly qualified, and has provided strong oversight focused on delivering superior, sustained shareholder value.

Disney also touted CEO Bob Iger’s track record of growth, and the transformative purchases of Pixar, Marvel, and Lucasfilm, while also arguing that even the 20th Century Fox acquisition was strategically significant. Humorously, Disney also dug at Nelson Peltz, contending that he doesn’t understand Disney’s businesses, lacks the skills and experience to assist the board, and doesn’t have any real plans for change. In so doing, Disney effectively used Peltz’s own words against him, citing fumbled responses he made during a CNBC interview.

Following that, Trian and Disney traded tepid letters, with the former advocating for Peltz to replace Michael Froman on the Walt Disney Company’s Board of Directors. Disney followed up by announcing their April shareholders meeting, and they urging shareholders not to vote for Peltz. Neither letter was particularly persuasive. It seemed the battle was already fizzling out.

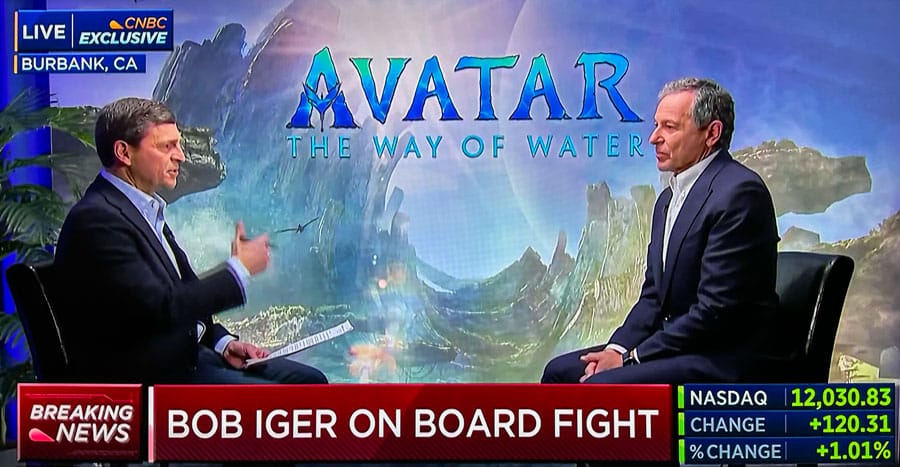

Finally, Bob Iger sat down with CNBC in Burbank for a wide-ranging interview covering succession planning, streaming strategies, restructuring, and his decision to return to the company. Bob Iger essentially reiterated a pitch about how he was turning the ship around. He asserted that Peltz would not add value or a fresh perspective to Disney’s board, and didn’t have any ideas that the company wasn’t already implementing.

Iger said he only had so much time and energy, and that needed to be focusing on improving Disney’s performance, and not on a “distraction.” Wall Street responded positively to both this call and Iger’s restructuring plans and new emphasis on theme parks and, as noted above, Disney shares traded higher to around $113.

Shortly after the Iger interview ended, CNBC “Squawk on the Street” host Jim Cramer spoke with Trian Partners Founder Nelson Peltz over the phone for a brief reaction. In response, Peltz said that his father told him that “you can only win once” and that “this was a great the shareholders had won. All of Trian’s concerns had been addressed, and they were impressed by what they heard.

“Management at Disney now plans on doing everything that we wanted them to do.” As a result, Peltz wished Bob Iger, his management team, and the Walt Disney Company’s Board of Directors the very best. Peltz indicated that Trian would be watching and he’d be rooting for them, and that “the proxy fight is over.”

Ultimately, it seems like a couple of things happened to result in the proxy fight unraveling in the spring. First, is that Peltz ‘shot his shot’ and made his best case at the beginning of the campaign, and his proxy fight ran out of gas as Iger resumed control, the stock price increased, and Iger had a performance on the earnings call that impressed analysts and investors. Against that backdrop, Peltz had a narrowing path to victory in the proxy fight.

As we noted at the time, Peltz had been gearing up for a battle with the unpopular CEO Bob Chapek and Disney’s stock price under $90, a looming recession, and disillusioned fans and employees. By this spring, all of those circumstances had materially improved. Peltz realized it, played the cards he was dealt, and folded the “Restore the Magic” proxy fight.

Well, things have once again materially changed and Peltz now has a much stronger hand. Objectively, there’s no denying that Disney’s stock price is worse now than it was in the spring or even when Chapek was ousted. Subjectively, it certainly seems like the second honeymoon with Iger is over among fans and investors. Although he’s made some noticeable improvements, our perception is that the consensus is that it’s too little and too slow–and that Iger is increasingly drawing more criticism for past missteps. Iger is the one who now, seemingly, faces a narrowing path to victory, at least in the near term.

The second thing that unraveled the prior proxy fight was that Disney did take Peltz’s complaints and suggestions to heart, even if the company denies that was the case. As we previously indicated, it’s fairly undeniable that the abrupt announcements of 3 BIG Changes at Walt Disney World to Improve Guest Experience & Value and Good Changes Coming to Disneyland had something to do with Peltz. It would have to be a pretty big coincidence that that news dropped hours before Peltz launched his proxy fight.

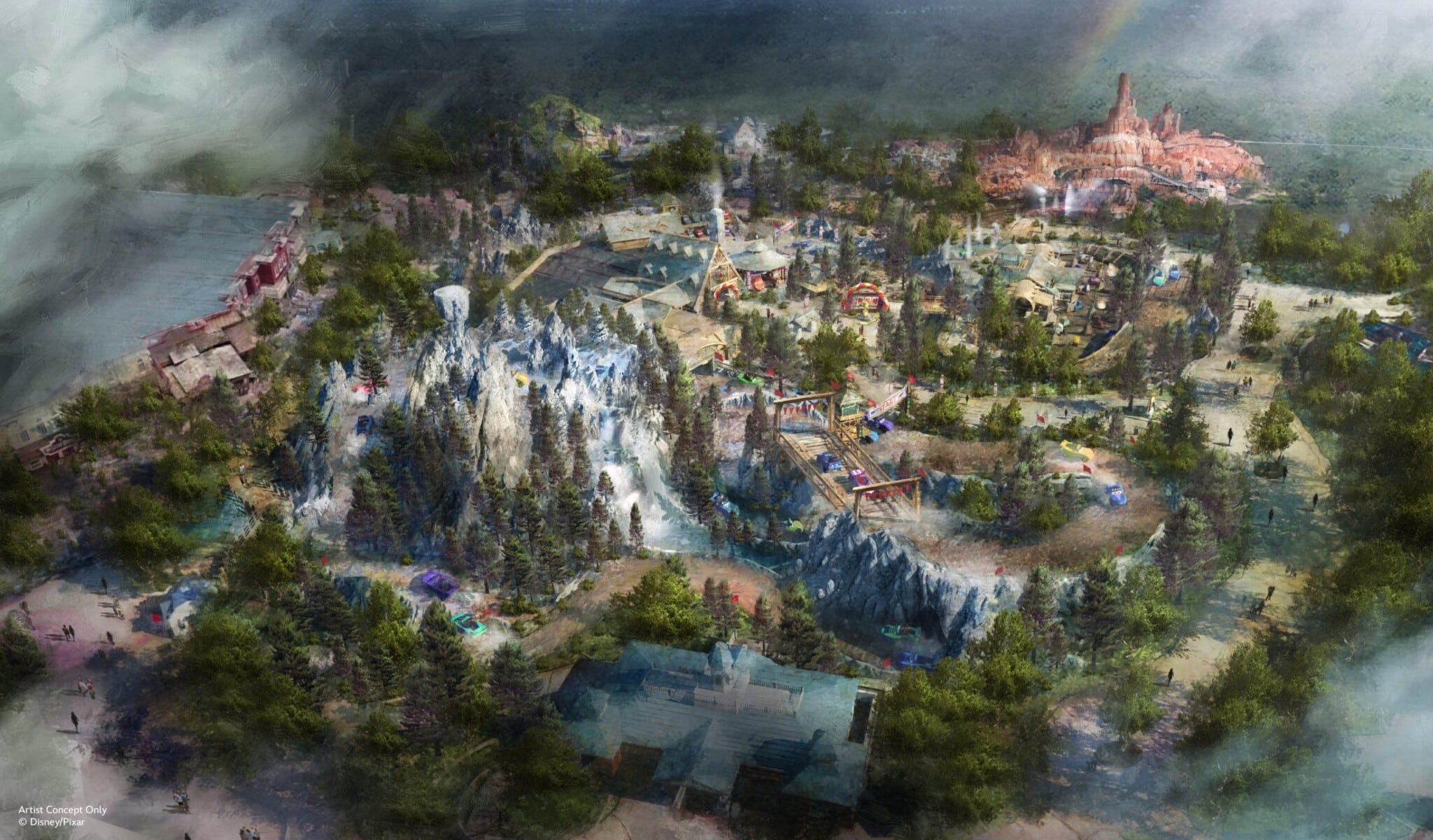

Since the original campaign concluded, the company has seemingly followed through on more of the concerns raised by Peltz. A lot has happened in the ensuing months, but our primary focus is theme parks, so the big thing that stands out to us is last month’s SEC filing, in which the company revealed that it will spend $60 billion over the next decade to expand and enhance Walt Disney World, Disneyland, Disney Cruise Line, and its international theme parks. This represents nearly double the amount invested over the last 10-year period, as Disney seeks to “turbocharge” its theme parks according to Iger and Parks Chairman Josh D’Amaro.

The Save Disney remake sequel specifics haven’t dropped just yet, so it remains to be seen what Peltz wants this go-round beyond seats on the board and a higher stock price. Once again, this could be a good thing for Walt Disney World and Disneyland, and the company as a whole. Among fans, there’s going to be an understandable skepticism towards an investor who is characterized as a corporate raider. That’s doubly true after years of corner-cutting in the parks and price increases aimed at meeting Wall Street expectations of quarterly gains.

However, there’s also arguably an ‘alignment of interests’ between Peltz and Disney theme park fans. Same goes with those who think the board of directors and Bob Iger need more accountability or independence. If you’re a fan of ESPN, Disney+ or Hulu, linear television, or other divisions of the company, perhaps you feel differently–as those are the areas that are much more likely to see cost-cutting and discipline in the future.

Need Disney trip planning tips and comprehensive advice? Make sure to read 2023 Disney Parks Vacation Planning Guides, where you can find comprehensive guides to Walt Disney World, Disneyland, and beyond! For Disney updates, discount information, free downloads of our eBooks and wallpapers, and much more, sign up for our FREE email newsletter!

YOUR THOUGHTS

Surprised that Peltz is reviving the proxy fight? What did you think about the “Restore the Magic” Campaign? Think this fight will be beneficial for the company and fans at the end of the day, or is it already over? Optimistic that this will push Iger to finally get serious about choosing a successor or focus on improving guest satisfaction in the parks? Thoughts on anything else discussed here? Do you agree or disagree with our assessment? Note that neither Disney nor Peltz brought up politics or culture wars in their presentations; as such, all off-topic comments about either will be deleted.