Disney reported its third quarter fiscal 2024 earnings, with the company’s Experiences reporting $8.4 billion in revenue. This covers the good & bad of these results as they relate to Walt Disney World, Disneyland and the international theme parks, and why despite the strong performance, CEO Bob Iger is warning investors of attendance softness and demand moderation through 2025.

The Walt Disney Company’s third quarter of fiscal year 2024 earnings beat analyst estimates, mainly as its combined streaming businesses turned a profit earlier than expected. Earnings per share were $1.39 versus $1.19 expected, and revenue was $23.16 billion versus $23.07 billion estimates.

Disney’s operating income increased a whopping 19% to $4.225 billion compared with the same period last year, led by the positive results for Disney’s entertainment division, again fueled by streaming. Despite this, Disney’s stock was down on the news, likely due at least in part to the “softness” for Parks & Resorts that’ll be discussed in this post…

To start on a positive note, Disney’s streaming business–Disney+, ESPN+ and Hulu–together turned a profit for the first time, and it happened a quarter earlier than the company had expected. The combined streaming business posted an operating profit of $47 million compared with a loss of $512 million in the same quarter last year.

This all comes before the password sharing crackdown has begun, which CEO Bob Iger indicated on the call would start “in earnest” in September. A similar crackdown by Netflix earlier this year caused profits to soar, although (editorializing a bit here) I would hazard a guess that differences in demographics would mean it’s not quite as fruitful for Disney as other streamers.

Remember, this was the same division that was losing over $1 billion per quarter at the end of the Chapek regime, and was a big reason why we got blue sky daydreaming for Parks & Resorts at the last D23 Expo. So while streaming is not the focus of this post or website, it absolutely is relevant to capital investments at Walt Disney World and Disneyland. Streaming has finally turned a corner, and now, so too should spending on major parks projects. A very, very bullish sign for the Horizons panel this weekend!

A perpetual bright spot amidst a sea of negative news for the last few years, the tables have turned and Parks & Resorts is now underperforming. Revenue for the overall Disney Experiences unit, which includes domestic and international parks and experiences, as well as consumer products, was up 2% to $8.386 billion. (This is as compared to the same quarter last year–encompassing summer through June 29, not this year’s previous quarter.)

Operating income for U.S. parks was down 6%, while international parks operating income was up 2%. Disney attributed the decrease in operating income at the domestic parks to higher costs driven by inflation, as well as increased technology spending and the lack of new guest offerings resulting in slowing consumer demand.

During the prepared executive remarks, Disney indicated that Parks & Resorts revenue growth was impacted by a “moderation of consumer demand towards the end of the third quarter that exceeded our previous expectations.” (Translation: a slower summer than they were initially projecting at Walt Disney World and Disneyland.)

All of this is consistent with what’s happening at Universal Orlando and Hollywood. Comcast recently held its quarterly earnings call, where the company revealed that revenue at Universal’s theme parks was down 11%.

Universal blamed the revenue drop on a few factors, including unfavorable comparisons to the pent-up demand period and an increase in other travel options, such as cruises and international tourism, given the strength of the dollar. They also attributed the decrease to a lack of new attractions in Orlando. In fact, two-thirds of the drop was tied to lower attendance at the company’s parks in Florida and California.

Executives further indicated that this downtrend was likely to continue until the opening of Epic Universe in 2025. Despite this, Comcast executives said they remained “bullish” on the business. (Easy attitude how awesome Epic Universe looks…but it does have pressure from investors to recoup the massive investment.)

Disney’s earnings call was more or less a repeat of that sentiment. Disney indicated that it expected the “demand moderation” at Walt Disney World to impact the next few quarters, meaning it would last into 2025. The company is “actively monitoring attendance and guest spending and aggressively managing [its] cost base” and expects next year’s operating income to decline by mid-single digits versus the prior year.

This will be due to ongoing demand decrease at Walt Disney World and Disneyland, plus negative impacts at Disneyland Paris from a reduction in normal consumer travel due to the Olympics, and cyclical softening in China. “The portfolio is working well,” Johnston said, while conceding there there was “softness in the domestic parks.” He also added that the lower income consumer is “feeling stress,” while higher income consumers are traveling internationally more.

Despite this demand dynamic, other parts of Disney’s portfolio delivered improved results versus the prior year, including Disney Cruise Line, Consumer Products, and some of the international parks. This was completely consistent to the previous earnings call, when Disney CFO Hugh Johnston indicated that it was basically the international parks overperforming, which makes sense due to lagged pent-up demand versus the domestic parks and more favorable comparisons in the prior-years. (Hong Kong Disneyland opened World of Frozen; Shanghai opened Zootopia.)

With regard to “turbocharged” investments in Parks & Resorts, Disney doubled-down on that during this earnings call. In the prepared remarks, the company indicated that “despite recent economic uncertainty that is impacting consumers, we remain confident about the long-term opportunities before us. Our Experiences portfolio is increasingly diversified, with more balanced contributions to segment operating income compared to pre-pandemic. We continue to significantly outperform pre-pandemic levels, with both segment revenue and operating income in Q3 FY24 exceeding Q3 FY19 levels by nearly 30%.”

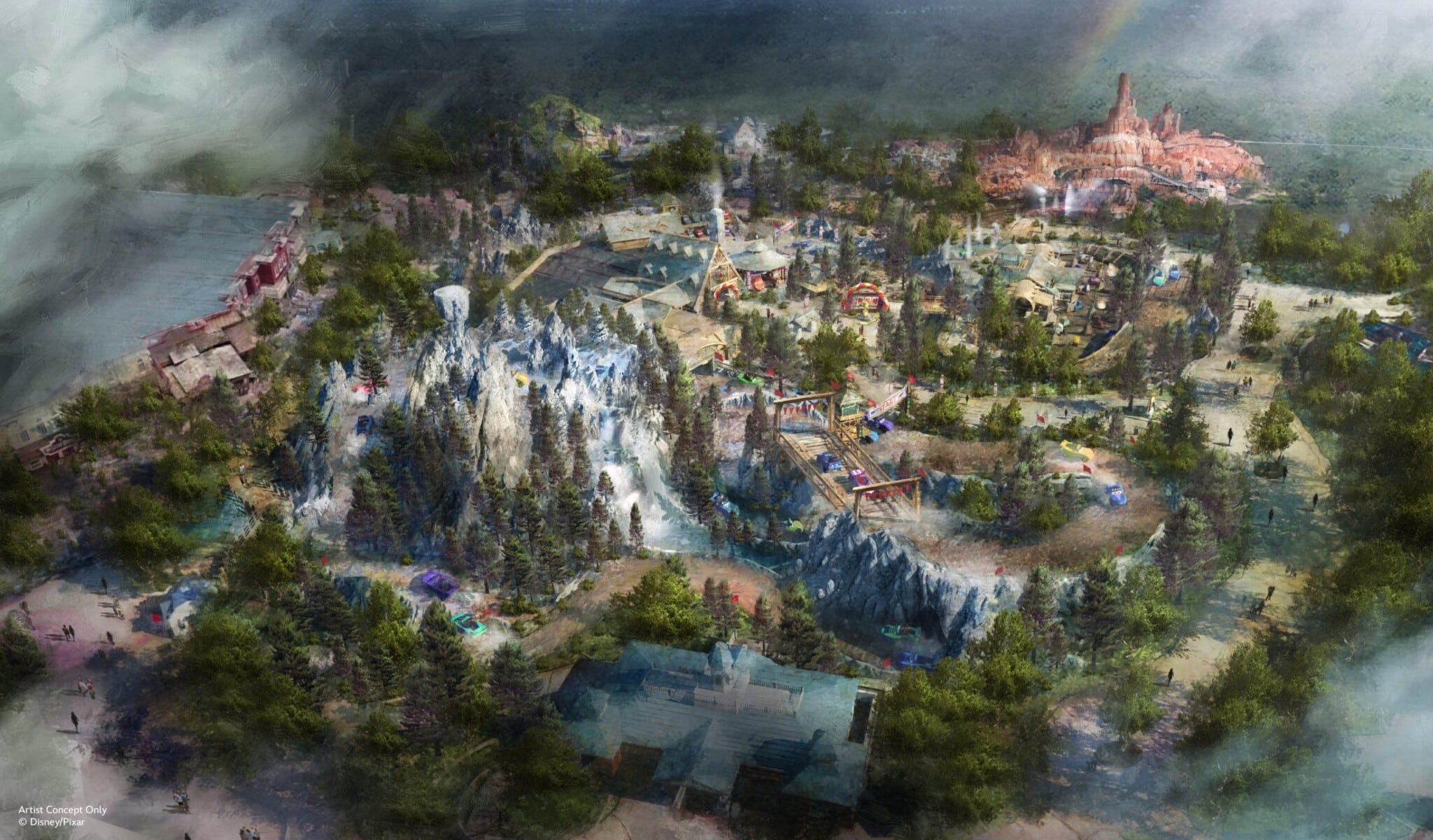

“We continue to expand our U.S. and international offerings, both on land and at sea, with new experiences and attractions that will increase capacity. At Disneyland Resort, the Anaheim City Council recently gave final approval to our DisneylandForward initiative – the first step in our expansion plans at Walt’s original theme park.”

During the Q&A, Johnston added that Disney feels “very, very good” about the investments they’re making into Parks & Resorts, as it’s been a great business for a long time. He added that Disney “wouldn’t be making capital investments in an accelerated way if we didn’t expect accelerated growth as well…but obviously we’re investing because we’re looking to accelerated growth–hence the term ‘turbocharge.\’”

In other words, don’t feel too badly for Disney during these trying times of normalizing attendance and demand. Walt Disney World and every other destination is still performing well above pre-COVID levels–with revenue, operating income, and per guest spending all up considerably at every destination as compared to fiscal year 2019.

This is starting to normalize, as Disney has had to pull more “levers” to entice guests to visit. In its presentation, Disney specifically said as much–that “promotional offers may be triggered at various times of the year” to offer “discount structures” and entice guests to visit.

As we’ve mentioned repeatedly, Walt Disney World has pulled out the 2019 deal playbook for 2024. It’s basically back to normal on the deal front, and most of these discounts have been released earlier than normal by historical standards, and offer better savings than their counterparts from the last two years. Some are superior to 2018 or 2019, but baseline prices and perks have also changed since then.

In something of an about-face, Disney also acknowledged Annual Passholders in a positive way: “We are fortunate to have an incredible community of annual passholders and Magic Keyholders, many of whom are our most loyal fans.” This was cited as a way to weather economic uncertainty and as the basis for long-term confidence in further investments in the parks.

Ultimately, this call went pretty much perfect from my perspective. Disney CEO Bob Iger and CFO Hugh Johnston were measured about the “demand moderation” at Walt Disney World and Disneyland through 2025, because the situation is still far from dire–the parks won’t be empty or dead, as you’ll see for yourself if you visit from October 2024 through March 2025. This will be painted as a five-alarm fire by those cheering for Disney’s downfall, but that’s not reality.

However, the parks are slowing down. I don’t know how anyone who visits regularly could deny it at this point–it’s plainly visible and the company itself is saying so (and yet, some fans still do!). Quite frankly, I view this as good news. Pent-up demand lasted longer than anticipated, and frankly, it was a distortion that had unhealthy consequences for the broader economy (beyond Disney). Putting that in the rearview mirror may be bad for the company, but it’s good for consumers and the country as a whole.

It’s a positive sign that this is happening at both Universal and Disney’s domestic theme parks, that both are acknowledging it’s in part due to a lack of compelling new offerings, and that both are bullish on the future thanks to investment initiatives. From my perspective, we’re in the “Goldilocks zone.”

If Parks & Resorts took too big of a hit, with revenue and attendance falling too much as a result of anticipated economic uncertainty or exhaustion of pent-up demand, that could’ve spooked Disney into nixing its “turbocharged” plans for $60 billion of investment. If the segment continued to overperform, there may have been no cause for a sense of urgency about investments–things are going just fine without adding new offerings. Instead, they’ve seen just enough of a downtrend to underscore that the parks are not on autopilot, and guests do need compelling draws (and not just discounts, which they’ve been doing aggressively for ~18 months at this point).

Lower demand that could lead to better incentives and initiatives to draw Annual Passholders to the parks is good for casual guests and diehard Disney fans. As with the arrival of Epic Universe, it seems that disgruntled former fans want to see Disney taken down a notch and are engaged in a lot of completely unmoored wishful thinking.

While I’d welcome even more of a “normalization” to bring numbers closer to 2019, I don’t want to see too much of a drop. This earnings call delivered precisely what I was hoping to see: improvements for pretty much all other divisions (streaming profitability is huge) coupled with a slight decrease for Parks & Resorts. All of this should give the company a renewed sense of urgency on those turbocharged investments, as well as the resources to turn its attention to theme parks, thereby further setting the stage for a blockbuster D23 Expo. Bring on the Parks Panel!

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What do you think of the Walt Disney Company’s ‘warning’ that attendance is going to continue to soften into 2025? Thoughts on a slowdown at Walt Disney World or Disneyland? Predictions about other “levers” the company will pull to boost demand and buoy bookings? Does this have you more bullish on the “turbocharged” plans for growth or a blockbuster D23 Expo? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!